SOPHIA ANTIPOLIS, France – December 16, 2024 │Following up on its Silicon Carbide (SiC) patent landscape 2022 [1], KnowMade is releasing a new intellectual property (IP) report providing a comprehensive view on the recent SiC patenting activities worldwide. In this report, KnowMade highlights the latest IP dynamics across the SiC supply chain and provides a focus on the IP activities of some of the main companies adopting a vertical integration model within the SiC industry.

Growing market competition and on-going geopolitical tensions fostering IP activities across the SiC supply chain

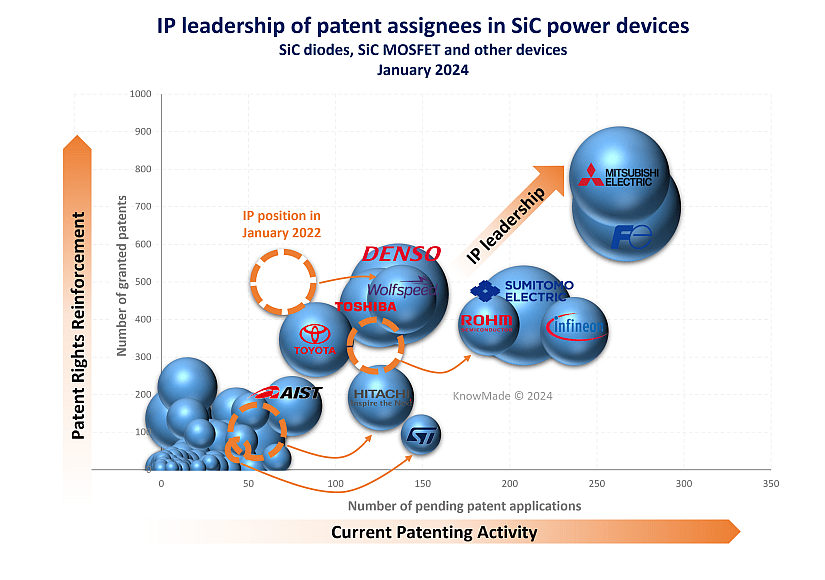

Since 2021, KnowMade has noticed interesting dynamics in the patenting activities related to SiC devices. For instance, the number of inventions disclosed in 2023 is more than 50% higher than it was in 2021. Furthermore, several incumbent patent holders have effectively enlarged the perimeter of protection for their SiC inventions. With the perspective of large-scale adoption of SiC power devices in electric vehicles (EV), SiC companies started filing more and more patents in strategic regions for this industry. At the same time, several pioneers in the fast-growing SiC market have accelerated their IP activities, anticipating the entry of many challengers in the SiC industry landscape (Figure 1). Indeed, patents could play a key role in asserting the market position of SiC companies in a highly competitive environment.

Figure 1: IP leadership of patent assignees in the SiC power device patent landscape [2].

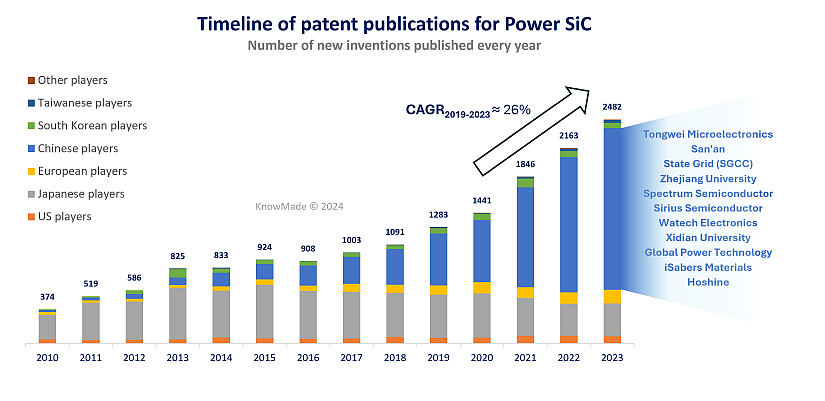

US-China trade war has also had a role to play in the recent acceleration of patenting activities, by supporting the establishment of more localized SiC supply chains across the world, especially in China. The number of inventions disclosed by Chinese players have increased by about 60% between 2021 and 2023 (Figure 2). Actually, the number of Chinese companies and research organizations involved in SiC activities is also growing fast, with more than 25 IP newcomers for SiC substrates, and about 50 IP newcomers identified for SiC devices since 2022. This dense local ecosystem has allowed China to rapidly solve the shortage issues in the SiC wafer industry. However, by initiating a lasting oversupply of SiC wafers, China brought about a tough price competition in the SiC wafer market, making a stronger case for SiC wafer suppliers to leverage their patents against their main competitors.

Figure 2: Timeline of patent publications for power SiC (number of inventions published every year).

Vertically integrated SiC companies exhibit different IP strategies across the supply chain

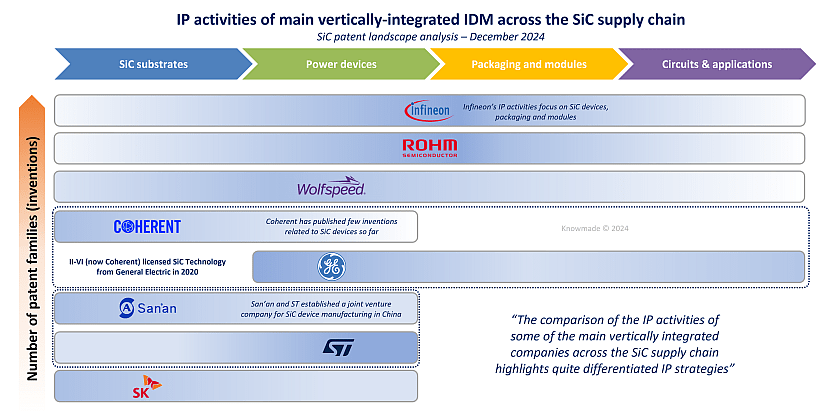

Several SiC device market players are investing a lot of resources into the establishment of a vertically integrated manufacturing infrastructure for SiC technology. These companies have adopted an integrated device manufacturer (IDM) business model in the SiC industry and aim to integrate within the company every step of SiC manufacturing, from material growth to device manufacturing and packaging. Interestingly, the comparison of their IP activities across the supply chain highlights quite differentiated IP strategies for SiC technology. While certain companies heavily rely on patents to assert their position in the market, other companies have not significantly developed their patent portfolio across the SiC supply chain (Figure 3). The geographic distribution of their patent filings also points out some discrepancies between SiC IDM companies, highlighting the relative importance of the different markets for each company (US, Japan, Europe, China, South Korea and Taiwan).

This is why one of the strategies adopted in this updated SiC patent landscape analysis consists of focusing on a limited number of key players, Wolfspeed, Infineon, onsemi, Rohm, SK, STMicroelectronics, Coherent (and its licensor General Electric), to draw an IP profile including every aspect of their patent portfolios (geographic breakdown, legal status of patents, technology breakdown, time evolution, etc.). Such an approach makes possible to detect small signals, such as a recent involvement in a new region or in a new technological area (superjunction devices, trench SiC MOSFETs, etc.). That is, diving into the recent patent filings of key players can provide valuable insights into the roadmap of SiC companies.

Figure 3: IP activities of main vertically integrated IDM across the SiC supply chain.

Patent landscape analysis: What is the strategy for SiC technology?

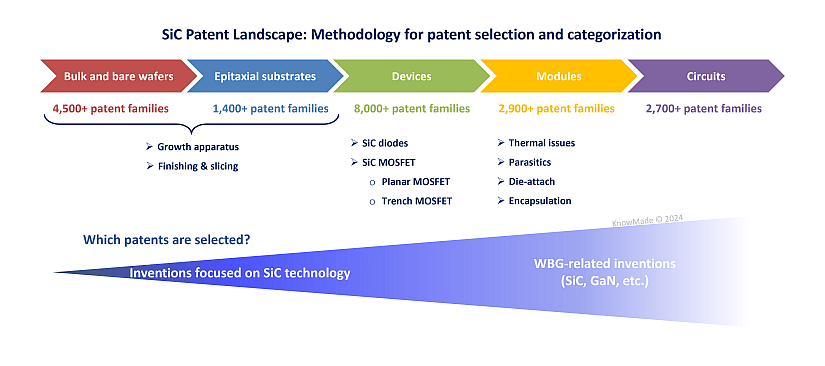

The main objective of the SiC Patent Landscape report 2024 is to describe the global patent competition across the SiC supply chain. This analysis starts with the identification of the main IP players and newcomers filing SiC-related patents across the supply chain, from bulk SiC to circuits and systems using SiC devices. Importantly, because patents related to packaging, modules, circuits and applications tend to cover more than just a single semiconductor technology, the scope of the selection must be tuned in the downstream supply chain (Figure 4).

Figure 4: Methodology for SiC patent selection and categorization.

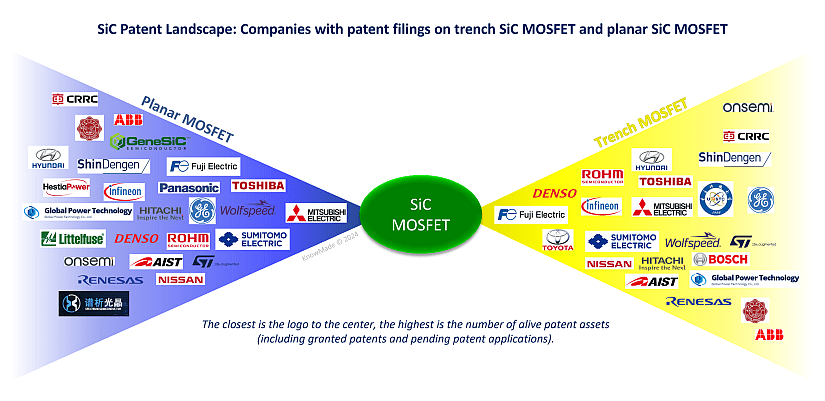

Once SiC patents have been selected, they are positioned in each part of the SiC supply chain: SiC substrates (including bulk SiC, bare wafers, growth apparatuses, finishing, slicing, epitaxial wafers), SiC power devices, packaging, modules, circuits and applications. By way of example, for SiC power devices, the patent analysis has been split into diodes, MOSFETs and other SiC devices. Furthermore, SiC MOSFET patents have been split into planar MOSFET patents and trench MOSFET patents to allow for a separate IP competitive analysis of each technology. The analysis points out that most companies in the SiC patent landscape have integrated trench MOSFET in their technological roadmap (Figure 5), leading to an acceleration of patent filings in this area. As a result, trench MOSFET has become an increasingly competitive IP space lately.

Figure 5: Companies with patent filings on trench SiC MOSFET and planar SiC MOSFET. The comparison is based on alive patent applications (incl. granted patents and pending patent applications).

Eventually, the SiC patent portfolios are also analyzed geographically to highlight important markets in the IP strategy of SiC companies. Patent assignees are split according to their headquarter countries, enabling the study of local ecosystems for SiC technology. Combining these different approaches, the analysis demonstrates that Chinese companies have filed a very limited number of their patent applications abroad (less than 5%). It suggests that, at least for now, most Chinese companies do not plan to challenge the leadership of their competitors outside China.

By the way, the Chinese government has been strongly encouraging the patenting activities of Chinese companies, leading to a huge number of patent applications filed in recent years. More than 70% of SiC patent applications published in 2023 worldwide are assigned to Chinese entities. This makes patent analysis a powerful tool to study the Chinese ecosystem emerging for SiC technology, as illustrated in a previous publication from KnowMade [3]. For instance, patent analysis proves to be very helpful for the early identification of new Chinese companies, the description of their technological developments and the explanation of their relationships with other players, such as research organizations or foreign companies (patent collaborations, patent transfers).

KnowMade has been investigating SiC technology since 2018, extending its patent analysis across the whole SiC supply chain over the years. In addition to its patent landscape analysis reports, KnowMade provides a patent monitoring service including quarterly updates on SiC technology and the flexibility to focus on the most critical aspects depending on your markets and your position in the value chain.

[1] Silicon Carbide (SiC) patent landscape 2022, KnowMade, May 2022

[2] Chapter 6 – Case Studies, SiC technology, Maurizio Di Paolo Emilio et al., Springer, 2024, https://doi.org/10.1007/978-3-031-63418-5

[3] Silicon Carbide (SiC) patents support the emergence of a complete domestic supply chain in China, KnowMade, January 2022

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Rémi Comyn works for KnowMade as a Senior Analyst in the field of Compound Semiconductors and Electronics. He holds a PhD in Physics from the University of Nice Sophia Antipolis (France) in partnership with CRHEA-CNRS (Sophia Antipolis, France) and the University of Sherbrooke (Québec, Canada). Rémi previously worked in compound semiconductors research laboratory as Research Engineer.

About KnowMade

KnowMade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.