Major companies have patented variety of solutions to protect their own AiP structures and manufacturing processes. What are the white spaces left? Is the freedom to operate hampered ?

Publication June 2021

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 80 slides

- Excel file > 660 patent families + hyperlink to updated online database (legal status, documents etc.)

- IP trends, including time-evolution of published patents, countries of patent filings, etc.

- Ranking of main patent assignees.

- Newcomers in the AiP IP landscape.

- Main technologies IP analysis:

- Flip Chip

- Fan Out

- Wafer Level Packaging

- Air cavity antenna

- Stacked antenna

- Focus on AiP patent portfolios of key players: SJSemi/SMIC, TSMC, Samsung Electro-Mechanics, Huawei, MediaTek, IBM, ASE, SPIL, NCAP, Qualcomm, Murata.

- Key players’ IP position and relative strength of their patent portfolios

Related patent landscapes on advanced packaging technologies. In-depth patent landscape and customized studies for strategic decision making.

Antenna integration becomes more and more advantageous at higher frequencies

Since 2017, Knowmade has been following the intellectual property (IP) trends related to RF front-end devices and their packaging. Recently, Knowmade witnessed increasing patenting activity related to PAMiD modules, RF front-end modules, RF filters and switch integration, and antennas for 5G and their packaging.

Packaging of 5G systems requires the integration of RF, analog and digital functions along with passives and other system components in a single module. These systems exemplify the heterogeneous integration trend which becomes more important for 5G. Proximity of the transceiver and front-end module is also important, to reduce size and loss. This is achieved by integrating antennas with the RF module as well as simultaneous modeling of a heat dissipation solution to keep active components in acceptable thermal conditions.

In the mm-wave antenna-in-package solutions, interconnections between transceiver ICs and antennas should result in low insertion loss and acceptable return loss over the frequency range of interest. The other key requirement is the form factor, and to meet it the industry is progressively moving from conventional interconnect techniques such as wire-bonding and flip-chip interconnections to emerging techniques referred to as Fan-Out packaging or IC-embedding. Flip-chip and Fan-out interconnections were originally developed for high-performance computing or mobile processor applications, but their fine pitch and low electrical parasitic have pushed RF players to use them in their RF/mm-wave modules. Today, these approaches are getting more and more critical for the RF industry and are used in antenna-integrated modules.

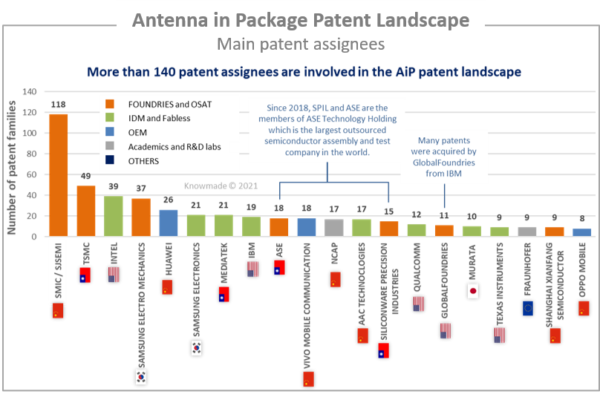

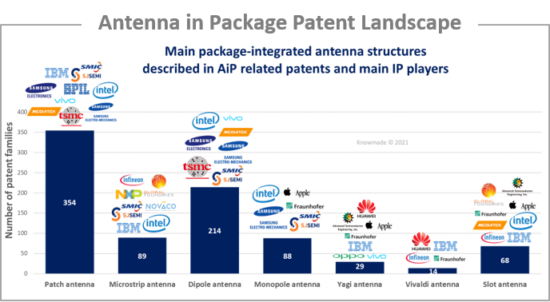

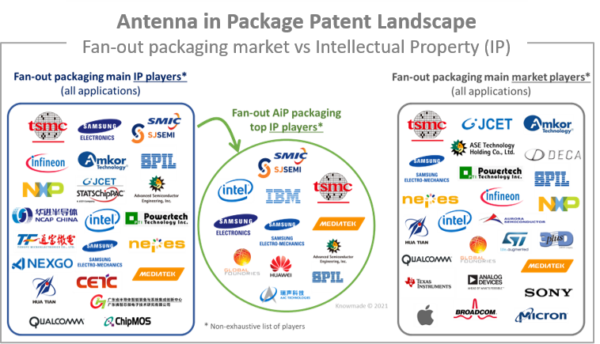

In this report, Knowmade analyzes the patent landscape related to antenna integrated in package (AiP, AoP). The AiP patent landscape is led by major semiconductor foundries and OSATs, SJ Semiconductor (SJSemi) being the main patent assignee, and it includes any links in the supply chain. Foundries/OSATs (SJSemi/SMIC, TSMC, SEMCO, ASE, SPIL) as well as IDMs/fabless (MediaTek, Qualcomm, Murata, TI, Skyworks) and OEMs (Huawei, Vivo mobile, Oppo mobile) have filed AiP-related patents to protect their structures/designs or manufacturing methods.

Understanding of the current IP players’ activities

Knowmade has identified more than 140 different entities that have filed patent applications related to AiP. The report provides a clear overview of the most active assignees as well as a presentation of IP newcomers. Furthermore, a patent segmentation reveals the technical position, e.g. WLP, Fan-Out, Flip Chip or antenna type, of each of the main players.

SJSemi, Intel and TSMC have the most significant enforceable portfolio; together they own one third of all granted patents. Over the last few years, SJSemi, TSMC, Samsung, MediaTek, Huawei, AAC Technologies and NCAP have been increasing their patenting activity.

The IP newcomers of the last 2 years are mainly Chinese companies that focus on a wafer-level packaging approach for integrated antenna: Vivo Mobile, OPPO Mobile, Shanghai Xianfang Semiconductor (subsidiary of NCAP), Powertech Technology, Microsilicon Technology, T-Ray Technology, Sky Semiconductor Technology, Xinhua Microelectronics and Unisoc.

Focus on the main IP players’ IP portfolios

The report provides a detailed analysis of the main IP players: SJSemi/SMIC, TSMC, Samsung Electro-Mechanics, Huawei, MediaTek, IBM, ASE, SPIL, NCAP, Qualcomm, and Murata. For each player, we highlight their strengths and weaknesses and provide information about their technology developments. Finally, a description and analysis of their key patents is provided.

The IP white-spaces are shrinking

The patents describe a variety of solutions to design or manufacture antenna systems in package, and not many patents are focused on critical technological bricks. The AiP patent landscape attests to well-mastered packaging solutions that are already available on the market and where the IP “white-spaces” will be quickly limited. Each player has developed and protected its own AiP structures/designs, each providing a solution to answer the different requirements of next-generation handset RF packages. The patents mainly claim specific AiP structures/designs or processes/methods for making them. Asserting owned patents against infringing products is easier with patents claiming an AiP structure/design, and patent litigation on such aspects will thus be inevitable in a growing 5G market.

Report’s main assets

Understanding the key players’ patented technologies and current IP strategies and strengths: More than 140 patent applicants are involved in the antenna in package patent landscape. This report reveals the IP position of key players through a detailed analysis of their patent portfolios. We also provide an understanding of these players’ patented technologies, their IP strategy, and their capability to limit other firms’ activity.

Analyzing IP players’ developed technologies: This report provides an understanding of the IP players’ recent technical developments. The main AiP approaches are sorted, and IP players and key patents are presented for each segment.

Identifying and understanding IP players’ key patents related to AiP: This report highlights the main IP players’ key patents related to AiP with a selection of the most influential/blocking patents.

Useful Excel patent database

This report also includes an Excel database with the 1,500+ patents and patent applications analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority date, title, abstract, patent assignees, patent’s current legal status, and technological segments.

Companies mentioned in this report (non-exhaustive list)

SJ Semiconductor, SMIC, TSMC, Intel, Samsung Electro Mechanics, Samsung Electronics, Huawei, Mediatek, AAC Technologies, Oppo Mobile, IBM, SPIL, Vivo Mobile, ASE, Fraunhofer, Qualcomm, Murata, Texas Instruments, NCAP, Broadcom, Powertech Technology, Sony, Fujikura, Saint Gobain, AT&S, Shanghai Xianfang Semiconductor, GlobalFoundries, Boeing, LG Electronics, CETC, Ericsson, Spreadtrum Communication, Raytheon, Bosch, Novaco Microelectronics Technologies, JCET, STATS ChipPAC, Chengdu T Ray Technology, Microsilicon Technology, Guangdong Xinhua Microelectronic Technology, Tsinghua University, TDK Epcos, New Kojinpeng Private, Hanyang University, Micron Technology, A*STAR, Core, National Chung Shan Institute of Science & Technology, Skyworks, Kyocera, Dupont Electronics, Institute of Microelectronics – Chinese Academy of Sciences, Forehope Electronic Ningbo, Dongwoo Fine-Chem, LS Mtron, Shanghai Amphenol Airwave Communication Electronics, Chunghwa Precision Test Technology, Innolux, Imec, Vega Grieshaber, Chengdu Ruishi Intelligent Technology, Nepes, Xiamen Yun Tian Semiconductor Technology, Guangdong Fozhixin Microelectronics Technology Research, Nanjing Qinheng Microelectronics, Qingdao Geer Intelligent Sensor, JCAP, etc.