Miniaturized gas sensors will be increasingly used in HVAC, air comfort for transportation and consumer applications. But do the key gas sensor market players have the best IP positions?

Publication December 2018

| Download Flyer | Download Sample |

Report’s Key Features

• PDF >140 slides

• PDF >140 slides

• Excel file >3,500 patents

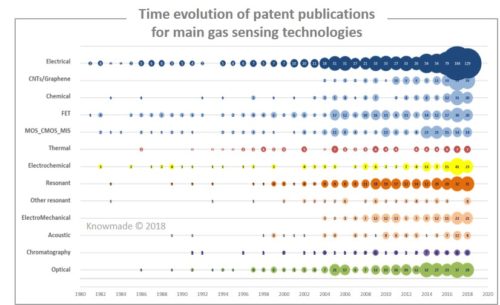

• IP trends, including time-evolution of published patents, and countries of patent filings

• Patents’ current legal status

• Ranking of main patent assignees

• Key players’ IP position and relative strength of their patent portfolios

• IP analysis of sensing technologies: electrical, thermal, optical, electrochemical, electro-mechanical, acoustic, chromatography, etc.

• Key players, new entrants and key patents for each sensing technology

• Key patents near expiration date

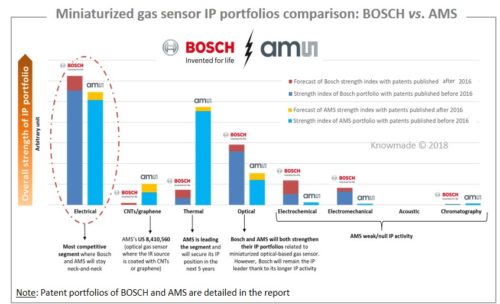

• BOSCH and AMS IP profiles and IP comparison

• Excel database containing all patents analyzed in the report, including technology segmentation

More IP analyses: MEMS, sensing, and imaging patent landscapes. In-depth patent landscape and customized studies for strategic decision making.

BOSCH and AMS dominate miniaturized gas sensor related patents

The gas sensor market is growing, driven by Heating, Ventilation and Air Conditioning (HVAC) and air comfort for transportation which are poised to experienced the highest Compound Annual Growth Rates (CAGRs) from 2017-2023 of 15% and 12.5% respectively, according to Yole Développement’s report Gas and Particle Sensors 2018. The miniaturization of gas sensors has allowed their introduction to consumer applications and their manufacture in large volumes. We believe miniaturized gas sensors will be increasingly used to resolve form-factor/cost issues in consumer, HVAC and air comfort for transportation applications. At the beginning of this new era for gas sensors, understanding the Intellectual Property (IP) position and strategy of historical gas sensor players as well as identifying the key IP players and the newcomers is crucial. In this report, Knowmade has thoroughly investigated the patent landscape related to miniaturized gas sensors, covering gas sensing technologies using micro-fabrication techniques to reduce form-factor, cost and power consumption. Our patent landscape analysis shows significant changes in the competitive IP landscape since our previous analysis in 2016. We have seen a big increase in patenting activity related to miniaturized gas sensors in 2017-2018, mainly due to new inventions from Bosch, AMS, NGK, Sensirion and from new entrants such as MicroJet Technology, Spirosure, Carrier Corporation, LG and Apple. The patent filings currently pending reflect a particular interest of the competitors in European and Chinese markets. Historical IP players Siemens, Honeywell and General Electric have the strongest patent portfolios, especially Siemens, which shows the most important contribution to the prior art in the field of miniaturized gas sensors. Bosch is indisputably this field’s current IP leader, and in the last two years it has strengthened its IP position in both miniaturized electrical and optical gas sensing technologies. AMS is the IP player that saw the biggest change in its IP position in miniaturized gas sensors in recent years. AMS’ IP portfolio now benefits from key patents from recent acquisitions of CCMOS Sensors, Applied Sensor and NXP’s CMOS sensor business, which today offer it the capability to limit the IP activity of other players, especially on electrical and thermal miniaturized gas sensors. TDK-Micronas and the CEA French R&D Lab own the highest number of enforceable patents relating to miniaturized gas sensors, but both decreased their patenting activity in the last two years, which could affect their IP position in the future.

The gas sensor market is growing, driven by Heating, Ventilation and Air Conditioning (HVAC) and air comfort for transportation which are poised to experienced the highest Compound Annual Growth Rates (CAGRs) from 2017-2023 of 15% and 12.5% respectively, according to Yole Développement’s report Gas and Particle Sensors 2018. The miniaturization of gas sensors has allowed their introduction to consumer applications and their manufacture in large volumes. We believe miniaturized gas sensors will be increasingly used to resolve form-factor/cost issues in consumer, HVAC and air comfort for transportation applications. At the beginning of this new era for gas sensors, understanding the Intellectual Property (IP) position and strategy of historical gas sensor players as well as identifying the key IP players and the newcomers is crucial. In this report, Knowmade has thoroughly investigated the patent landscape related to miniaturized gas sensors, covering gas sensing technologies using micro-fabrication techniques to reduce form-factor, cost and power consumption. Our patent landscape analysis shows significant changes in the competitive IP landscape since our previous analysis in 2016. We have seen a big increase in patenting activity related to miniaturized gas sensors in 2017-2018, mainly due to new inventions from Bosch, AMS, NGK, Sensirion and from new entrants such as MicroJet Technology, Spirosure, Carrier Corporation, LG and Apple. The patent filings currently pending reflect a particular interest of the competitors in European and Chinese markets. Historical IP players Siemens, Honeywell and General Electric have the strongest patent portfolios, especially Siemens, which shows the most important contribution to the prior art in the field of miniaturized gas sensors. Bosch is indisputably this field’s current IP leader, and in the last two years it has strengthened its IP position in both miniaturized electrical and optical gas sensing technologies. AMS is the IP player that saw the biggest change in its IP position in miniaturized gas sensors in recent years. AMS’ IP portfolio now benefits from key patents from recent acquisitions of CCMOS Sensors, Applied Sensor and NXP’s CMOS sensor business, which today offer it the capability to limit the IP activity of other players, especially on electrical and thermal miniaturized gas sensors. TDK-Micronas and the CEA French R&D Lab own the highest number of enforceable patents relating to miniaturized gas sensors, but both decreased their patenting activity in the last two years, which could affect their IP position in the future.

Analysing patents of each sensing technology

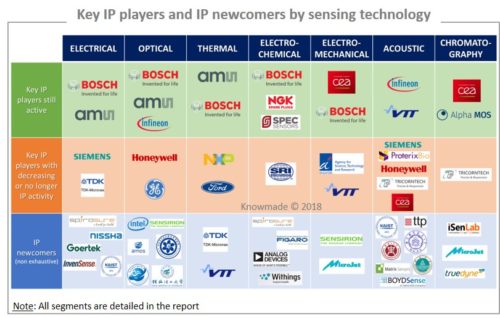

The patents have been categorized according to the claimed sensing technology, including electrical, thermal, optical, electro-chemical, electro-mechanical, acoustic and chromatography. In this report we analyze patents of each sensing technology and discuss the relative strength of the patent assignees, highlight the key patents and identify the IP newcomers.

The patents have been categorized according to the claimed sensing technology, including electrical, thermal, optical, electro-chemical, electro-mechanical, acoustic and chromatography. In this report we analyze patents of each sensing technology and discuss the relative strength of the patent assignees, highlight the key patents and identify the IP newcomers.

From a patent point of view, the electrical and thermal technologies remain the two most competitive miniaturized gas sensor segments. TDK Micronas and Siemens are the best established IP players in miniaturized electrical gas sensor segment, but they suffer from low patenting activity levels that limit their ability to strengthen and develop their IP position in coming years. Bosch and AMS will stay neck-and-neck in the electrical IP segment while AMS is leading the thermal segment and will probably secure its IP position in the next few years. Bosch and AMS currently compete in the thermal gas sensors IP segment, while TDK-Micronas and VTT are just entering the IP landscape. The IP landscape relating to miniaturized optical gas sensors is also competitive but less settled than the electric one. Honeywell is the most established IP player with the highest number of enforceable patents and several seminal patents. Bosch is leading patenting activity in optical sensing technology, but Infineon and AMS are its two main IP competitors.

The electro-chemical gas sensor-related IP landscape is small but has seen a strong boost in patenting activity in 2017 thanks to Bosch’s new patent filings on solid electrolyte technology. Beside other IP players involved in electro-chemical sensing technology like NGK and Spec Sensors, we noticed the entrance of Spirosure, which has co-filed patents with NGK, Analog Devices, Figaro Engineering and Withings, which was formerly Nokia Health.

The patenting activity related to electro-mechanical gas sensors has shown a progressive increase since 2012. The electro-mechanical IP segment is dominated by academic players like the CEA in France and by recent patenting activity of Bosch, and we observed the entrance of IP newcomers like MicroJet Technology, Sensirion and Nissha.

Infineon is currently the most active IP player in miniaturized acoustic gas sensors. Other key patent owners involved in acoustic sensing technology are Siemens, Honeywell, CEA, Tricorntech, VTT and ProterixBio. The IP landscape relating to chromatography-based miniaturized gas sensors comprises few patents owned by R&D labs like CEA and small companies like Alpha MOS, MicroJet Technology, TrueDyne Sensors, iSenLab.

The report also includes an Excel database with the >3,500 patents analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority date, title, abstract, patent assignees, each patent’s current legal status, and sensing technologies.

Companies mentioned in the report (non-exhaustive)

Bosch, AMS, Siemens, Honeywell, TDK-Micronas, NGK, CEA, Infineon, VTT, General Electric, Figaro Engineering, LG, Spec Sensors, Spirosure, Sensirion, MicroJet Technology, iSenLab, Truedyne, InvenSense, Tricorntech, Alpha MOS, ProterixBio, NXP, Ford, Nissha, Goertek, Sumitomo, Withings, Analog Devices, A*STAR, CalTech, Cyrano Sciences, PARC, Toshiba, Fujitsu, Intel, amos, SRI International, KAIST, NUAA, etc.