New comers and emerging applications for oncology and infectious diseases are driving the growth of microfluidics IP.

Publication January 2017

| Download Flyer | Download Sample |

Report’s Key Features

- PDF > 100 slides

The report provides essential patent data for microfluidic technologies for diagnostic applications including:

- Time evolution of patent publications and countries of patent filings

- Current legal status of patents

- Ranking of main patent applicants

- Joint developments and IP collaboration network

- Key patents and granted patentsnear expiration

- Relative strength of main companies IP portfolio

- IP profiles of 15 major companies

- The report also provides an extensive Excel database with all patents analyzed in the study

Linked healthcare patent reports. Stay ahead of the curve with our comprehensive patent landscape and custom studies.

Microfluidic technologies: A great progress for diagnostic applications

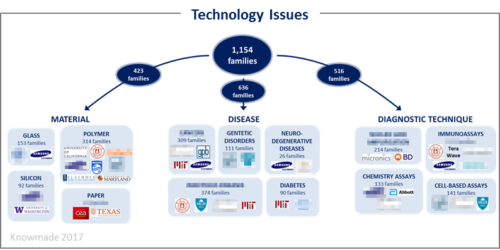

Microfluidic technologies have brought numerous advantages in diagnostic applications: smaller systems, small sample volume, near-patient technologies, reduced processing time and cost reduction. The scope of applications for microfluidic technologies for diagnostic applications is very broad: genetic, infectious, oncology, blood coagulation or cardiac pathology. It impacts therapeutic approaches by allowing a specific and quick detection and characterization of the disease as well as an easier evolution monitoring. The patent landscape related to microfluidic technologies claiming diagnostic applications is very open, providing space for both academic and industrial applicants. This landscape represents more than 1,150 families, including over 4,500 patents, and over 500 patent applicants are involved. Surprisingly, several important market players on the field of microfluidic technologies do not appear among the main patent applicants, and unexpected companies in this field, such as HP, have filed a lot of patents recently. Thereby this report provides an interesting overview on the IP situation. Microfluidics are cross-disciplinary technologies and a lot of patented systems can be adapted for various applications. Therefore, although some key market companies do not appear among the main patent assignees, they are nevertheless involved in several patent infringement cases. Moreover, our partner Yole Développement has estimated recently that the market for microfluidic chips and microfluidic-based tests for point-of-need testing applications, which is only a part of microfluidic for diagnostic domain, should increase from $6 billion in 2015 to $ 17.2 billion in 2021. Thus, the number of patent litigations cases related to microfluidic technologies in the biomedical domain is expected to increase. Therefore, it is essential to know key patent applicants in this area and understand their IP strategies. The analysis of the technical issues addressed by patents related to microfluidic technologies for diagnostic applications supports what we observed on the market. This indicates that the patented technologies are linked to the market and have a high potential for application.

Identify key players

The report provides a ranking and analysis of the relative strength of the top patent holders derived from their portfolio size, patent citation networks, countries of patent filings, current legal status of patents. Through this thorough analysis, we have identified 10+ major players, each of which is profiled in this report. Each profile includes a detailed portfolio analysis with patent activities, key patents, impact of portfolio, granted patents near expiration and IP strategies. The IP landscape for microfluidic technologies for diagnostic applications is shared between industrial and academic players. Among the main applicants, a lot of American companies appear.

Identify main current IP applicants

The IP activity of American applicants involved in microfluidic technologies for diagnostic applications can explain the predominance of US patent filings observed. However, all non-American main applicants also choose US as main priority country. China and Europe represent a particular interest for further patent extensions. Current main IP applicants include players with a steady IP activity who are extending their portfolio to different countries as well as new players with an intense IP activity in 2016.

Strength index of patent portfolios

The strength index of a patent portfolio is linked to the number of forward citations received. In this analysis, Caltech is ranked first with a medium sized patent portfolio. Caltech owns two key patent families claiming microfluidic nucleic acid analysis and its patent portfolio is cited a lot by Fluidigm. Other, such as Ningbo University, hold large portfolio, but it shows a very low strength index. Its patented technologies are rather young and have currently a very low impact in the domain of microfluidics for diagnostic applications.

Useful patent database (4,500+ patents)

This report also includes an Excel database containing all of the analyzed patents. The database allows for multi-criteria searches and includes patent publication number, hyperlinks to the original documents, priority date, title, abstract, patent assignees and legal status for each member of the patent family.

Companies and academics cited in the report (non-exhaustive)

Abbot, Agilent, Alere, BD, Bio-Techne, Caliper, Caltech, Cellectricon, Fluidigm, Fluxion Biosciences, GPB Scientific, Gyros, HandyLab, HP, Idex, Illumina, MGH, Micronics, MIT, Ningbo University, PerkinElmer, Philips, ProteinSimple, Roche Diagnostics, Samsung Electronics, Siemens, University of California