How will mRNA disrupt conventional cancer therapies?

How are industry leaders and start-ups positioned in these game-changing treatments?

Publication September 2022

| Download Flyer | Download Sample |

Report’s Key Features

- PDF > 100 slides

- Excel database containing all patents analyzed in the report (>570 patent families), including patent segmentations and hyperlinks to an updated online database.

- IP trends, including time evolution of published patents, countries of patent filings and patents’ legal status

- Ranking of main patent assignees

- Key players’ IP position and relative strength of their patent portfolios

- Summary of the IP related to RNAs and carriers: specific RNA type (circRNA, saRNA), RNA modification & stabilization, carriers (vesicle, virus, peptide, polymer, lipid).

- Summary of the IP related to treatment: antibody, immuno-modulator, antigen (direct or via DC), modified antigen receptor.

- Analysis of collaboration and EP patent oppositions.

Access all KnowMade’s patent reports on healthcare. Strengthen your IP strategy with our custom studies and patent landscape analysis.

Context of the report

For nearly three decades, extensive efforts have been made to increase RNA intracellular stability, translational efficiency and uptake of mRNA. Several players have taken an interest in this issue, such as mRNA technology leaders CureVac, Moderna and BioNTech. These optimizations were achieved by modifying RNA non-coding elements (5′ cap, 5′- and 3′- UTRs, 3′ poly-A tail) and RNA coding region, and through the development of formulation technologies with specific carriers. In cancer immunotherapy, the most advanced application of mRNA is therapeutic vaccination with mRNA encoding antigens, i.e., direct cancer vaccines or dendritic cell vaccines. Moreover, for more than a decade, industrialists and academics have been developing personalized cancer vaccines, based on the specific molecular features of patients’ tumors, to elicit an immune response against neoantigens produced by cancer cells. Other applications of mRNA in cancer immunotherapy include engineering T cells with modified antigen receptors such as CAR-T, immunomodulator production such as cytokines, co-stimulatory ligands and receptors, and antibody delivery. Currently, there are more than 600 clinical trials in progress, and this number continues to increase, reflecting the growing interest in this topic as well as the economic stakes for companies. However, to date, there is still no product on the market, but several patent oppositions have already been initiated against key patents. Around 20 opposition proceedings have been identified herein, most of which were filed in the past five years and still pending. By winning the race for the Covid-19 vaccine, mRNA vaccines have proven their worth, and demonstrated that RNA-based therapies can deliver on their promises. Additionally, it highlighted the advantages of mRNA over conventional therapies: active at a relatively low dose range, can be developed rapidly, and GMP-compliant manufacturing processes easily upscaled for rapid availability of large numbers of doses. All progress made in the development of Covid-19 vaccines will certainly help advance the development of mRNA-based cancer therapies. In this evolving context, it is crucial to understand the intellectual property position and strategy of these different players. Such knowledge can help detect business risks and opportunities, anticipate emerging technologies, and enable strategic decisions to strengthen market position.

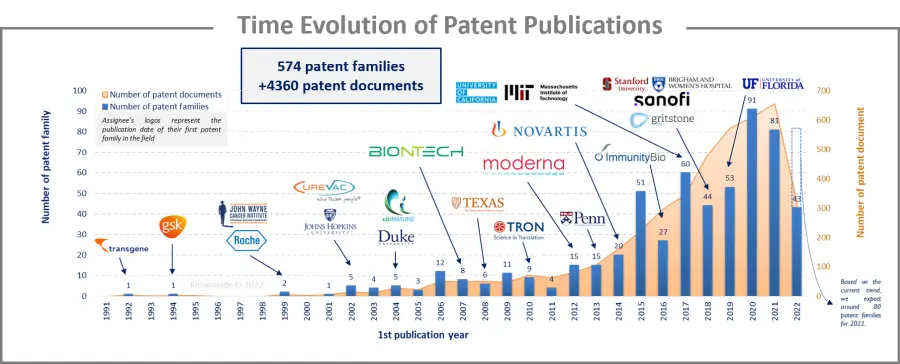

Analysis of the time evolution of patent publications shows that mRNA cancer therapies started to be investigated in 1992, but the technology emerged in the early 2000s with European companies such as CureVac and BioNTech, and American Universities such as Johns Hopkins University, Duke University and Texas University. In 2015 and 2017, two peaks are observed, resulting in an increase in the number of patent applicants. Moreover, in 2017, Moderna published 11 patent families and CureVac 7 patent families. As of 2019, this trend continues. Indeed, the increase in patent publications mainly corresponds to an increase in the number of assignees rather than an increase in the number of patent families for a player, even if BioNTech published 15 then 11 patent families in 2020 and 2021 respectively.

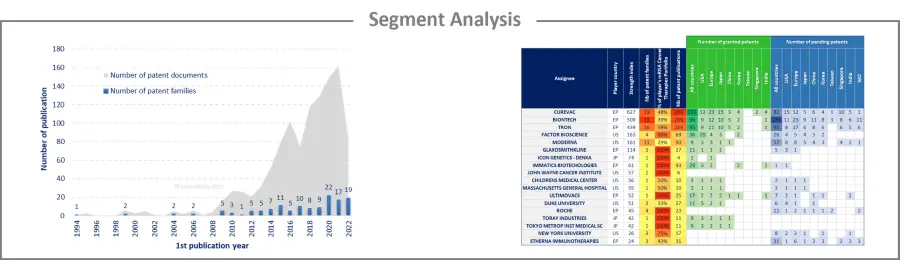

Analysis by segment

mRNA cancer therapies have been investigated and the selected patent families labeled according to the technologies to which they relate. This IP landscape features the following five types of segmentation: specific RNA type (circRNA, saRNA), RNA modification & stabilization, carriers (vesicle, virus, peptide, polymer, lipid), delivery route (tumoral, parenteral, other) and therapy (mRNA encoded antibody, immunomodulator, antigen via DC loading, antigen via direct injection, modified antigen receptor).

For each segment, the patent publication timeline, patenting strategy and patent portfolios of the main players have been analyzed.

EP oppositions

There is a significant number of EP oppositions, which reflects the strategic issues of mRNA cancer therapies for companies. Most of the proceedings are recent, filed in the past five years, and are still pending. For each opposed patent, the application date, assignee, opponent, opposition year and results are detailed.

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to mRNA cancer therapies, 50 newcomers were identified. These companies are either start-up firms (20) or established companies (30) developing their first technology in the mRNA field. These technologies are mainly related to carriers or to mRNA encoded specific proteins. Numerous IP newcomers are based in the US and in Asia, while some are based in Europe. It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

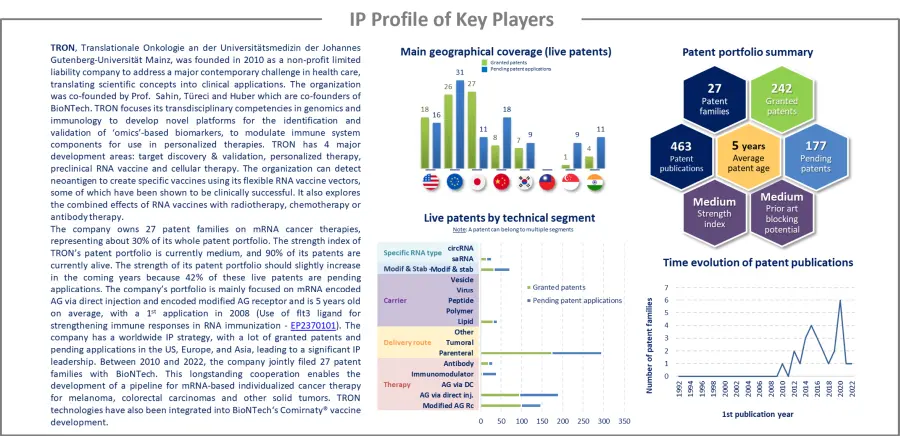

IP profile of key players

This IP study includes a selection and description of the key players. The patent portfolio analysis of key players includes a description of the assignee, key numbers in terms of patents, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of all the assignee’s key patents and by a table with its clinical trials.

Moreover, the report also includes an Excel database with the 574 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent’s current legal status and segmentation.

Companies mentioned in this report (non-exhaustive list)

BioNTech, Cellectis, CoImmune, CureVac, eTheRNA immunotherapies, Factor Bioscience, Gritstone bio, ImmunityBio, Moderna, Myeloid Therapeutics, Novartis, RIKEN, Sanofi, Shanghai Telebio Biomedical, Tricision Biotechnology, Nutcracker Therapeutics, Orna Therapeutics, etc.