RNA vaccine: Who owns key technologies for this new vaccine paradigm?

Publication January 2021

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 100 slides

- Excel file > 480 patent families + hyperlink to updated online database (legal status, documents etc.)

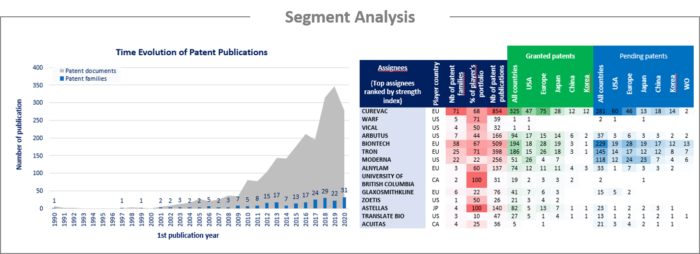

- IP trends, including time-evolution of published patents, and countries of patent filings

- Ranking of main patent assignees

- Key players’ IP position and relative strength of their patent portfolios

- Summary of the IP related to applications: Infectious Diseases and Cancer therapy.

- Summary of the IP related to technologies: RNA Delivery and RNA modifications.

- Analysis of patent oppositions (Europe) and review of key patents

Discover more patent landscapes on life science innovations. Enhance your competitive advantage with our custom studies and patent landscape.

RNA vaccines represent a major challenge for the pharmaceutical industry

The idea of using mRNA as vaccines has been investigated for nearly three decades. By winning the race for a Covid-19 vaccine, mRNA vaccines have proven their worth, and it has highlighted their advantages over conventional vaccines. Now, all major pharmaceutical companies are, in some way, testing out the technology by entering into license agreements and/or collaboration with well-established RNA companies (Pfizer, Sanofi, AstraZeneca, GSK, Merck, Roche, Bayer, etc.). Now that the first products have arrived on the market, IP positions have to be defined as companies will enforce their patents to secure their positions on the market. Patent litigations have already been initiated before the EPO and the USPTO against key patents. Over 30 opposition proceedings have been identified herein, most of which were filed in the past 2 years and still pending. In this context, Arbutus recently succeeded in maintaining one of its key US patents covering its LNP delivery system, that could potentially cover Moderna’s RNA vaccine. However, as Moderna already announced, it is unlikely that patents will be enforced during the pandemic. The speed at which an mRNA vaccine can be designed has been the key to the recent success. Indeed, the first batches for human testing were made in less than 2 months, and authority approvals were granted in less than a year. Clinical trials have demonstrated their safety and efficacy on mRNA vaccine candidates (about 95% effective in preventing COVID-19). Beyond a COVID-19 vaccine, RNA technology holds high promise for new vaccines against cancer and challenging viruses that conventional vaccines have failed to address (e.g. HIV, HSV, RSV). Moreover, this emerging technology successfully triggers antigen-specific T cell responses in cancer therapy. It also allows personalized immunotherapy by matching the genetic profile of each person’s cancer and inducing an immune response against the mutated part of the tumors (cancer neoantigen vaccines). In this evolving context, it is crucial to understand the intellectual property position and strategy of these different players. Such knowledge can help detect business risks and opportunities, anticipate emerging technologies, and enable strategic decisions to strengthen market position.

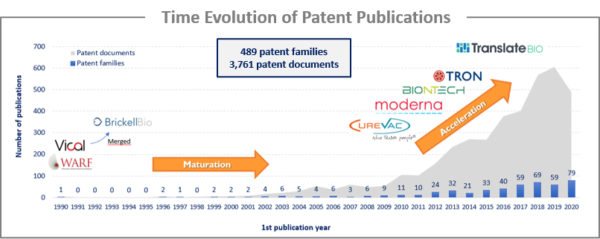

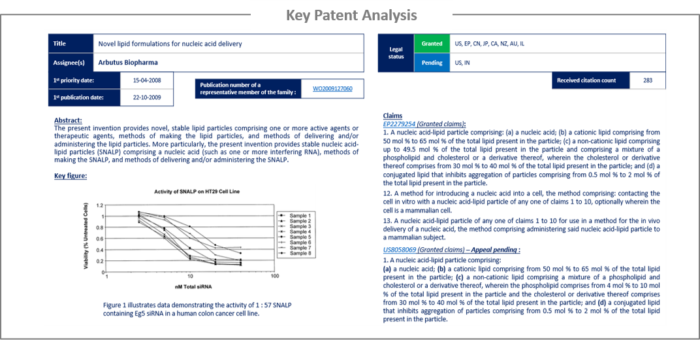

The first patent family identified was published in 1990. However, the technology was in a maturation phase up to 2010, as evidenced by a relatively low number of patent publications. This maturation phase was mostly related to the problem of rapid naked RNA degradation and the delivery system. One of the key discoveries that allowed the mRNA vaccine field to expand was based on research by Karikó et al. (2005 and 2008) on the incorporation of modified nucleoside into mRNA to increase stability and to ablate the mammalian innate immune response through the activation of Toll-like receptors (patented technology filed by the Trustees of the University of Pennsylvania). The other key discovery was the use of lipid particles to protect and deliver the RNA molecule into the cells (patented by Protiva Therapeutics, now Arbutus Biopharma). The combination of these two discoveries allowed the field to expand, with an approximate 9-fold increase in patent publications between 2009 and 2020.

Analysis by segment

Patent families identified in the report are primarily disclosed mRNA vaccines for the treatment of infectious diseases and cancer, RNA delivery systems, and methods of stabilizing the RNA molecules for optimizing translation and half-life (chemical and non-chemical modifications; optimized sequences, cap structure, poly(A) tail, 3’ and 5’ UTR, ORF). For each segment, the patent publication timeline, patenting strategy and patent portfolios of top players have been analyzed. The present IP landscape features the following technological segmentation:

Infectious diseases: The main RNA players already have numerous RNA vaccines in development against various viruses, e.g. COVID-19, Influenza virus, Ebola virus, Marburg virus, Zika virus, Rabies virus, cytomegalovirus, HIV, Yellow fever and others.

Cancer: mRNA cancer vaccine targets include Tumor-Associated Antigens (TAA) or neoantigens (antigens derived from genetic alterations and are tumor-specific). The latest in particular provided promising results as it allows personalized immunotherapy by inducing an immune response against the mutated part of the tumors.

RNA delivery: RNA vaccines rely on a delivery vehicle for efficient cellular uptake and degradation protection. Lipid nanoparticles is now the method of choice for encapsulating and delivering RNA vaccines.

RNA modification/stabilization: Studies directed to 5′ and 3′ UTR regions, 5′ cap, poly (A) tail, codon or nucleotides have proven essential to enhance the RNA stability/half-life and translation efficiency of the mRNA molecule.

Identifying the key companies and newcomers in the IP landscape

Among the players that have filed patents related to RNA vaccines, over 10 newcomers were identified. These companies are established companies developing their first products in the RNA vaccine sector. Most IP newcomers are based in the US and Europe, while only two were identified in Asia. Many mRNA companies identified have already entered into partnerships to advance their broader vaccine development programs through license agreements and/or joint research. The present report identifies numerous jointly filed patent families resulting from such collaboration, as well as press releases disclosing licensed agreements. Moreover, patent assignment analysis reveals players entering the field through the acquisition of patent families.

Key patent analysis

This IP study includes the selection and description of key patents. The key patent analysis includes the family’s legal status for each of the main territories, the number of received citations, the review of the main claim(s) (European and/or US claims), a description of interesting features of the innovation disclosures and relevant figures illustrating how the innovation works. The report also contains information about opposition in Europe.

Excel database

Moreover, the report also includes an Excel database with the >480 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees and segmentation. The Excel database also includes hyperlinks to an updated online database (legal status, documents etc.) for each selected patent family.

Companies mentioned in this report (non-exhaustive list)

MODERNA, CUREVAC, BIONTECH, GLAXOSMITHKLINE, TRON, TRANSLATE BIO, ARCTURUS THERAPEUTICS, ACUITAS THERAPEUTICS, ARBUTUS BIOPHARMA, ETHERNA, ALNYLAM PHARMACEUTICALS, ASTELLAS, MORPHOGENESIS, VACCIBODY, PCI BIOTECH, etc.