How can saRNA revolutionize mRNA treatments?

Are mRNA vaccines leaders positioned on this new saRNA technology?

Publication February 2023

| Download Flyer | Download Sample |

Report’s Key Features

- PDF>100 slides

- Excel database containing all patents analyzed in the report, including segmentations + hyperlink to updated online database (legal status, documents etc.)

- IP trends, including time evolution of published patents, countries of patent filings and patents’ legal status

- Ranking of main patent assignees & analysis of their patented technologies

- Key players’ IP position and relative strength of their patent portfolios

- Summary of the therapeutic applications: cancer, SARS CoV2, influenza, hepatitis, HIV, veterinary.

- Summary of the carriers used to saRNA encapsulation: VRP, LNP, liposome, CNE, polymer.

- Identification of newcomers and start-up firms.

- Analysis of collaborations and EP patent oppositions.

- Key patent selection (highly cited & granted patents with broad claims)

Access all KnowMade’s patent reports on healthcare. Advance your patent strategy with our custom studies and in-depth patent landscape analysis.

Report context: saRNA vaccine, a more effective descendant of mRNA vaccine?

The pandemic has led to research effort and global coordination, resulting in the rapid development of mRNA vaccines and human clinical trials. Currently, there are 2 main types of mRNA vaccines: conventional non-amplifying mRNA and self-amplifying mRNA (saRNA or replicons). saRNAs are larger than non-amplifying mRNAs and maintain auto-replicative activity derived from an RNA virus vector. saRNA vaccines contain an antigen-encoding sequence and viral RNA polymerase-encoding sequence required for replication. The advantage of the self-replicating approach is that significantly higher amount of antigen can be expressed with lower doses of mRNA, and it achieves longer term expression of the antigen. In addition to clinical benefits such as stronger immune responses, lower vaccine doses and reduced adverse effects, saRNA would have advantages at manufacturing levels. The saRNA vaccine platform may have higher manufacturing productivity and lower cost per dose compared to mRNA vaccines. In human saRNA vaccine, the most advanced application is therapeutic vaccination against cancer or SARS-CoV2, with saRNA encoding tumor antigens (specific or associated) or spike proteins, respectively. Moreover, this innovative and less expensive therapy tends to apply to the veterinary area with treatments for companion animals and livestock. Main other applications of saRNA vaccine are directed against infectious diseases such as influenza, hepatitis and HIV. Currently, there are less than 100 clinical trials in progress, but this number is increasing, reflecting the interest in this topic as well as the economic stakes for companies. However, to date, there is still no product on the EP and US markets, but some patent oppositions have already been initiated against key patents. Thirteen EP opposition proceedings have been identified herein, most of which were filed in the past 5 years and are still pending. With these initial tensions concerning patents and in a swiftly growing technological environment, it is essential to comprehend the Intellectual Property (IP) stance and strategy of these different players. Such insight can help spot business risks and opportunities, foresee forthcoming technologies, and enable strategic decisions to bolster market position.

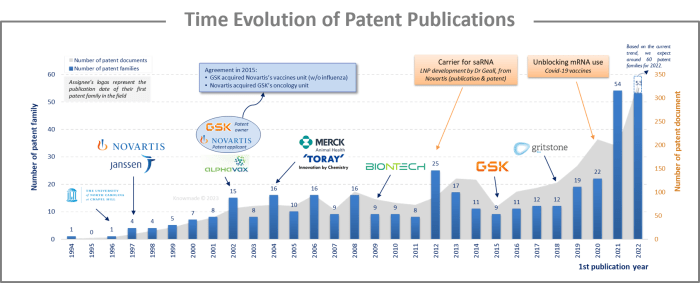

The analysis of the time evolution of patent publications shows that interest in saRNA began in the early 1990s, but it did not gain significant traction. However, in 2012, some scientists seized the first opportunity to encapsulate large saRNAs in lipid nanoparticles (LNP) instead of using viral particles. This was strongly proposed by Novartis researchers who showed that a 9 kb saRNA encapsulated in an LNP elicits broad, potent, and protective immune responses comparable to those of viral delivery technology, but without its inherent limitations. The second decisive event was the use of mRNA in human therapy during the COVID-19 pandemic in 2020, leading to the development of the first mRNA COVID-19 vaccine. These two events allowed saRNA technology to fully develop and led to a significant increase in the number of patent families published in 2021 and 2022, which doubled from 2021 to 2022.

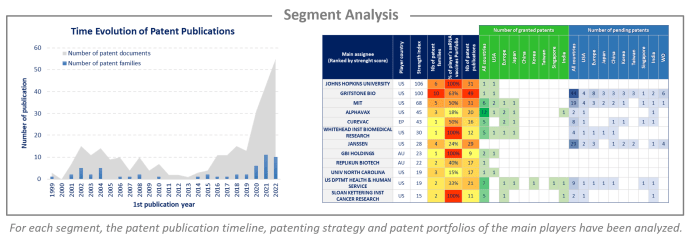

Analysis by segment

saRNA vaccines have been investigated and the selected patent families labeled according to technologies to which they relate. This IP landscape features the following 2 types of segmentation: therapeutic applications (based on the main object of the invention) and carriers (based on examples describing which delivery systems are used). The therapeutic applications are divided into cancer, SARS-Cov-2, HIV, hepatitis, influenza and veterinary, while the carriers are separated into VRP, LNP, liposome, CNE and polymer.

EP oppositions

There is a significant number of EP oppositions which reflects the strategic issues of saRNA vaccines for companies. Most of the proceedings are recent, having been filed in the past 5 years, and are still pending. For each opposed patent, the application date, assignee, opponent, opposition year, and results are detailed. Moreover, currently, 225 patents have been granted in the US and Europe. For each of these granted patents, an analysis of the scope of the first claim was carried out manually. This analysis made it possible to identify 44 patents with granted claims providing broad protection to their holders. These patents are detailed in this study (grant date, expected expiration date, and main concepts claimed).

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to saRNA vaccines, 21 newcomers were identified. These companies are either start-up firms (8) or established companies (13) developing their first technology in the saRNA field. These technologies are mainly related to SARS-CoV-2 and cancer. Numerous IP newcomers are based in the U.S., while some are based in Europe and Asia. It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

IP profile of key players

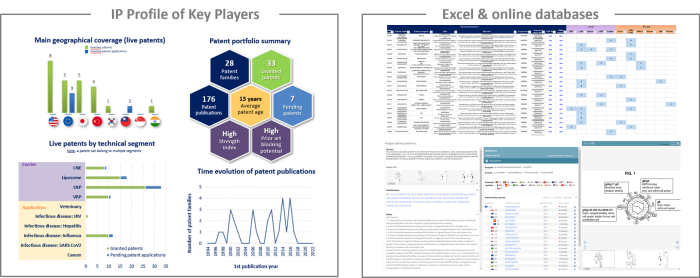

This IP study includes a selection and description of main players. The patent portfolio analysis of main players includes a description of the assignee, patent portfolio description, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of the technological content of their key patents and by a table with its clinical trials.

Moreover, the report also includes an Excel database with the 392 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent’s current legal status and segmentation.

Companies mentioned in this report (non-exhaustive list)

ALPHAVAX, ARCTURUS THERAPEUTICS, BIONTECH, BOEHRINGER INGELHEIM – ANIMAL HEALTH, CSL – SEQIRUS, GRITSTONE BIO, GSK, JANSSEN, MERCK MSD, MERCK MSD – ANIMAL HEALTH, NOVARTIS, PFIZER, REPLIKUN BIOTECH, SANOFI, TENGEN BIOMEDICAL, TIBA BIOTECH, TORAY INDUSTRIES, etc.