Which patent owners are ready to dominate the GaN power market in coming years?

Publication November 2019

| Download Flyer | Download Sample |

Report’s Key Features

- PDF with > 270 slides

- Excel file > 9,500 patents

- IP trends, including time-evolution of published patents, countries of patent filings, etc.

- Ranking of main patent assignees

- Key players’ IP position and relative strength of their patent portfolios

- Patent segmentation:

- Vertical power device (vertical transistor, vertical diode),

- Normally-off (E-mode transistor, cascode topology),

- Integration (monolithic E/D-mode, SiP/SoC, power IC),

- GaN-on-Si,

- GaN-on-Sapphire,

- Selective area p-type doping (ion implantation, p-GaN regrowth),

- Current collapse,

- Thermal management,

- Stray inductance,

- EV/HEV,

- fast charging,

- wireless charging.

- Key patent identification and details

- IP profile of 40 key players: Infineon, Panasonic, Toshiba etc.

- Excel database containing all patents analyzed in the report, including technology and application segmentations

Discover all KnowMade work on power electronics patent activity. Enhance your competitive advantage with our patent landscape and custom studies.

Power GaN intellectual property (IP): high-voltage power semiconductor leaders, a core set of strong IP players and numerous newcomers

Things are starting to change for GaN power electronics ! Power GaN is entering mainstream consumer applications with the adoption of GaN HEMT by Chinese OEM Oppo in its 65W fast chargers. In addition, GaN is getting attention from various OEMs and Tier1s in the automotive industry. GaN is also expected to penetrate industrial and telecom power supply applications (datacom, base-stations, UPS, etc.). Yole Développement projects that the GaN power market will be worth over $350M by 2024, with a compound annual growth rate (CAGR) of 85%.

The power electronics industry is familiar with the companies that are actively promoting GaN technology, such as EPC, GaN Systems, Transphorm, Navitas, Exagan, Infineon or ON Semiconductor. Today, more companies are either joining the market, have announced ambitions to do this, or have betrayed their intentions through their patent publications. Many firms have GaN power patenting activity, and a core set of strong companies, with strong technology and IP, are ready to dominate the GaN power market in coming years.

In this report, Knowmade has thoroughly investigated the patent landscape related to GaN-based technologies and devices for power electronics applications. We have selected and analyzed more than 9,500 patents and patent applications published worldwide up to May 2019 and grouped into more than 4,100 patent families. These patents pertain to epiwafers (GaN-on-Si, GaN-on-Sapphire, etc.), semiconductor power devices (D-mode, E-mode, vertical device, p-doping, etc.), integration (SiP, SoC, monolithic integration, etc.), circuit and operating methods (cascode, half-bridge, power IC, etc.), and packaging (thermal management, stray inductance, etc.), for all functions (switch, converter, rectifier, inverter, etc.) and applications (power supply, PV, EV/HEV, UPS, fast charging, wireless charging, etc.).

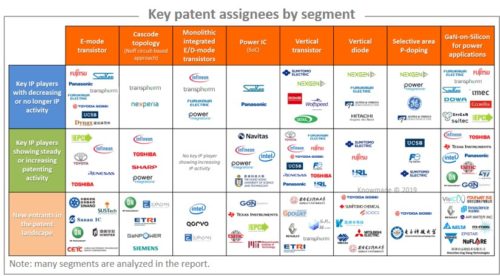

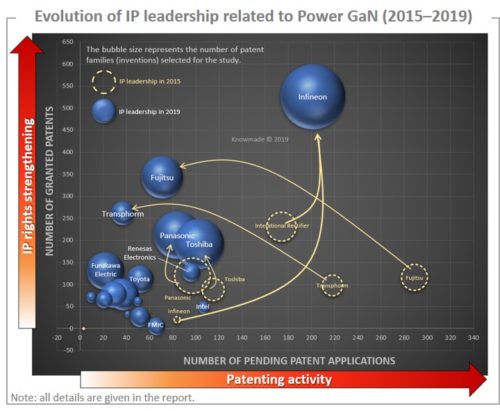

Since our previous Power GaN report, published in 2015, IP benchmarks herald changes in the GaN power industry and the ramp-up of GaN power market. All power electronics market players are present in the Power GaN patent landscape: Infineon, Fuji Electric, Toshiba, Sanken Electric, ON Semiconductor, STMicroelectronics, Renesas Electronics, Texas Instruments, Dialog Semiconductor, Power Integrations and Nexperia. Most of them are intensifying their Power GaN patenting activity and are enlarging their IP geographic coverage from the US and Japan to new key regions for the GaN power market, namely Europe and China.

In just a few years, Infineon and Transphorm have reached the strongest IP position in the patent landscape. This offers them the capability to limit the freedom-to-operate of competitors who develop GaN technology for power electronics. Infineon definitely has the strongest IP portfolio to front the growing of GaN power market. Transphorm is a major force in the power GaN IP arena, well ahead of the other GaN pure-players, EPC, GaN Systems, Navitas, Exagan or VisIC. According to our analysis, Transphorm today has the dream patent portfolio for all those who want to benefit from strategic advantages in GaN power electronics market. Some weak signals lead us to believe the first 650 V GaN-on-Si FETs from Nexperia announced in November 2019 may use Transphorm’s patents.

No matter how GaN providers manufacture power devices, they must consider GaN power patents held by Infineon, Transphorm, Furukawa Electric, Panasonic, Toshiba and Fujitsu. They must also watch other players that are strengthening their IP position such as EPC, Renesas, ON Semi, Toyota, TI, TSMC, Intel, Toyoda Gosei and Sanken. More newcomers of different types are entering the Power GaN patent landscape. Startups include Exagan, Navitas, Cambridge Electronics, GaNPower and Innoscience. New substrate providers include Qromis, AirWater and Zing Semiconductor. Foundries include FMIC, HiWafer, Simgui, Nuvoton, Sinopower and VIS. Integrators include Nissan, Shindengen Electric Manufacturing, Nidec, Kyocera, Hella, Renault, Apple, Midea, Huawei and Velodyne Lidar. China has made an impressive move into Power GaN IP with numerous entrants since 2017.

GaN-on-Silicon and GaN-on-Sapphire

In the report we detail the IP landscape related to GaN-on-Silicon and GaN-on-Sapphire. The GaN-on-Silicon patent landscape is characterized by the presence of numerous GaN pure-play companies and numerous Chinese new entrants. In the GaN-on-Sapphire patent landscape, Power Integrations is the best-known player. However, numerous other players have also developed IP related to GaN-on-Sapphire for power applications, including CorEnergy, Powdec and Seoul Semiconductor.

Normally-off

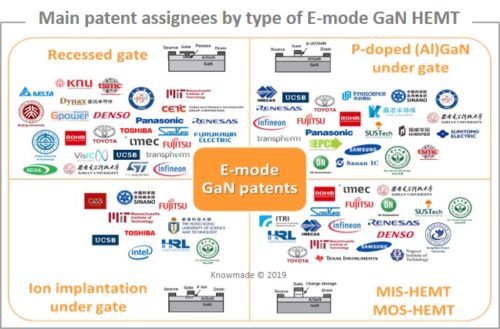

Infineon leads the IP landscape related to cascode topology thanks to key patents from International Rectifier acquired in 2014. Fujitsu and Transphorm have strong patent portfolios related to E-mode GaN transistors. Infineon, EPC and Renesas are currently the most active IP players. In the report we have identified key patents from key IP players and new entrants for both cascode and E-mode transistors. Furthermore, we map the different solutions claimed in patents to make E-mode transistors.

Integration

We have been witnessed of a growing IP activity for power GaN System-on-Chip with Infineon/IR, Intel and Navitas as the main patent applicants. Infineon and Intel have been developing IP for monolithically integrating GaN power devices with other kind of devices such as RF circuits and LEDs, and/or Si CMOS technology. On the other hand Navitas’s patents focus on all GaN Power IC. Other players hold patents on monolithic integration such as Intel, Dialog, Power Integrations, Transphorm, Exagan, ON Semiconductor, GaN Systems, TI, EPC, TSMC. Some other companies recently filed patents related to GaN-on-Silicon-on-Insulator for power electronics.

Vertical power device

Vertical power devices still attract significant attention of patent applicants. Nexgen (formerly Avogy) is the main patent owner, but it has stopped its patenting activity, like Fujitsu and Furukawa. Today, Toyoda Gosei, Fuji Electric, Sumitomo Electric and Toyota are leading the vertical power device IP landscape. Several players are developing IP on vertical devices on silicon substrates including CEA/Renault, Vishay, Renesas, Bosch, Fuji Electric, Furukawa Electric and M-MOS Semiconductor. This report highlights selective ion implantation and selective p-GaN regrowth to form selective p-type regions.

Current collapse and driving applications

We see important IP activity to suppress current collapse, with Fujitsu, Panasonic and Toshiba as main patent assignees. We identify IP players claiming solutions to prevent this dynamic on-resistance increase (field plates, surface passivation, hole injections). In the report we also highlight Power GaN patents explicitly targeting EV/HEVs from CEA/Renault, Toyoda Gosei, Denso, Toyota, CACTi, KOYJ, Shinny, Sentec, China Motor and Egtronics, fast charging from Powdec and Shinny and wireless charging from EPC, Panasonic, Navitas, Rohm, and Hosiden.

Companies mentioned in the report (non-exhaustive)

Infineon, International Rectifier, Toshiba, Panasonic, Fujitsu, Furukawa Electric, Transphorm, Sumitomo Electric, Sharp, Toyota Motor, Toyota Central R&D Labs, Fuji Electric, Xidian University, Toyoda Gosei, Renesas Electronics, UESTC, Nexgen, Avogy, Sanken Electric, University Beijing, Founder Microelectronics IC, Rohm, Intel, Seoul Semiconductor, Samsung Electronics, Sun Yat Sen University, Texas Instruments, On Semiconductor, TSMC, Mitsubishi Electric, HRL Laboratories, Power Integrations, CorEnergy, Denso, NXP, Freescale, Nexperia, SINANO, CEA, Gpower, EPC, IMECAS, Imec, Qorvo, Delta Electronics, Institute of Semiconductors, NTT, LG Electronics, Samsung Electro Mechanics, Cree, Wolfspeed, Hitachi, CETC, LG Innotek, Navitas Semiconductor, Sciocs, Sumitomo Chemical, NEC, ETRI, Macom, Nitronex, Innoscience, Nexperia, Enkris Semiconductor, Gan Systems, Japan Radio, Midea, MIT, STMicroelectronics, Epistar, Exagan, Richtek Technology, HKUST, Soitec, Epigan, NGK Insulators, Peking University, Bosch, IBM, Murata Manufacturing, Siemens, Alpha & Omega Semiconductor, Coorstek, General Electric, Hiwafer, SUSTech, Foshan Tk Semiconductor, University of California, VisIC Technologies, CNRS, Dowa Electronics Materials, Powdec, SNU, ITRI, Ku Leuven, Qromis, Sanan IC, SETi, Vishay, A*STAR, Cambridge Electronics, Dialog Semiconductor, Dynax Semiconductor, Ganpower, Globalfoundries, Huawei, Simgui, University of Florida, Air Water, IQE, M-MOS Semiconductor, University of Sheffield, Zing Semiconductor, Allos Semiconductors, Arizona State University, Fraunhofer, Hella, KETI, Korea Advanced Nano Fab Center, Kyocera, Nuvoton, Shin-Etsu, Sigetronics, Sony, University of Illinois, University of South Carolina, US Navy, Alstom Transport, ASTRI, Caltech, Nissan Motor, North Carolina State University, Renault, Sixpoint Materials, Velodyne Lidar, etc.