KnowMade has just released a new report, updating this analysis in 2024.

Follow this link to discover it: Silicon Carbide (SiC) Patent Landscape Analysis 2024.

Figure out the IP strategy of main players and newcomers in the emerging SiC ecosystem. A vertically-integrated innovation strategy combined with a global patenting activity provides multiple ways to overcome the high entry barrier in SiC industry and secure a market leadership for the next decade.

Publication May 2022

| Download Flyer | Download Sample |

Report’s Key Features

![]()

- PDF >200 slides

- Excel database containing all patents analyzed in the report (>13,700 patent families), including patent segmentations and hyperlinks to an updated online database.

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

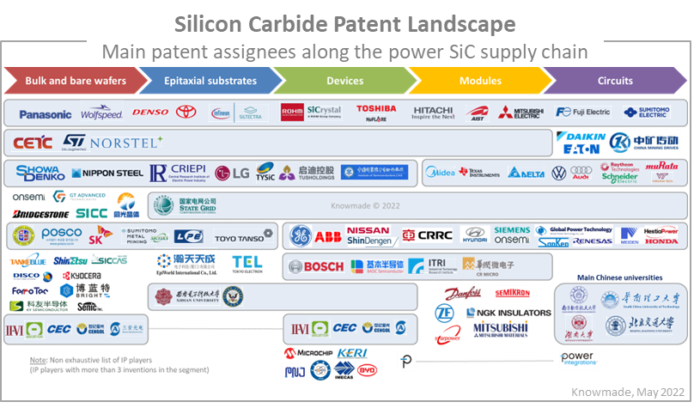

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active / inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

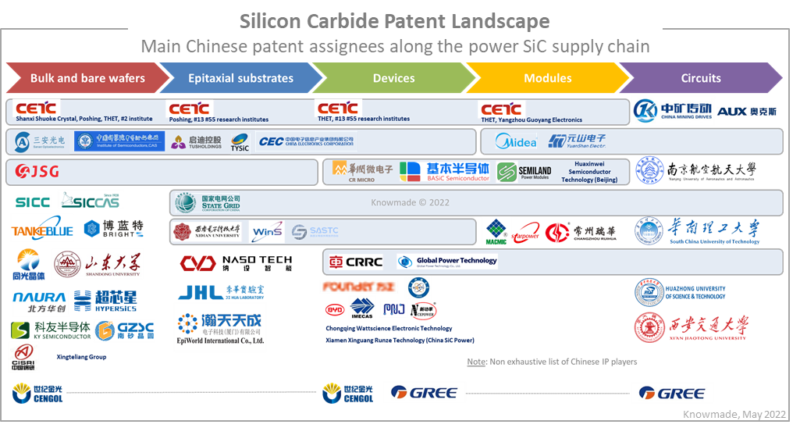

- Providing a detailed picture of the Chinese SiC ecosystem focusing on the patenting activity of Chinese entities.

- Patents categorized in 5 main supply chain segments and 10 main sub-segments: bulk SiC & bare SiC wafers, epitaxial SiC substrates (growth apparatus, finishing), SiC devices (diodes, planar MOSFETs, trench MOSFETs), SiC modules (thermal issues, parasitics, die-attach, encapsulation), circuits.

- IP profile of main players:

- Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

- IP strategy and key patents.

- Recent IP activity.

KnowMade patent landscapes on semiconductor technologies.

A complete description of a patent landscape by KnowMade.

Context of the report

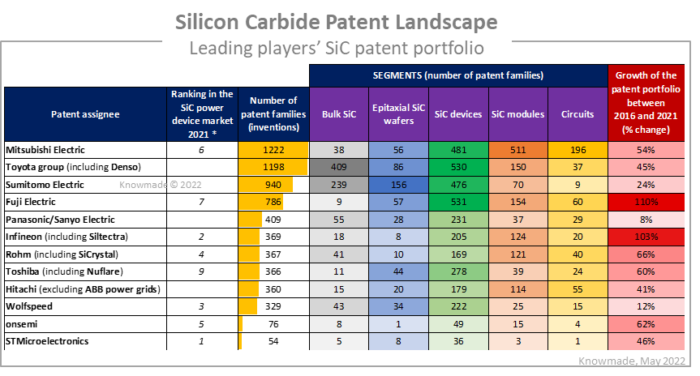

The Silicon Carbide (SiC) power device market is growing fast, driven by the adoption of SiC technology in electric vehicle (EV) applications. The SiC power device market revenues exceeded 1 $B in 2021 and were earned by companies mainly located in Europe (STMicroelectronics, Infineon), in the US (Wolfspeed, onsemi) and in Japan (Rohm Semiconductor, Mitsubishi Electric, Fuji Electric). What’s more, Yole Développement recently forecasted a multi-billion dollar SiC power device market for the next years, exceeding 6 $B in 2027 with an estimated CAGR of 34% in 2021-2027. Obviously, the other major nations in the semiconductor industry, including China and South Korea, have unveiled their ambitions to develop their own SiC industry. Yet their ability to build the whole supply chain required for power SiC technology in the short or mid-term has been questioned, especially regarding the establishment of a domestic supply for SiC wafers. Indeed, the entry barrier in SiC wafer business is remarkably high, as attested by the very limited number of companies currently able to mass produce large-area and high quality SiC wafers to power device makers, so that they can comply with the stringent device requirements expected from the EV industry.

In this context, Knowmade is releasing a new patent landscape report which aims to provide a comprehensive view of the power SiC patent landscape along the whole supply chain / value chain (bulk SiC & bare SiC wafers, epitaxial SiC substrates, SiC devices, SiC modules and circuits). Patent landscape analysis is a powerful tool to identify new players in emerging industries, way before they enter the market, while providing a better understanding of their expertise and know-how in a specific technology. Overall, the patenting activity (patent filings) reflects the level of R&D investment made by a country or a player in a specific technology, while providing a hint about the technology readiness level reached by the main IP players. What’s more, the technology coverage along the value chain and the geographical coverage of the patent portfolios are narrowly related to the business strategy of IP players.

Driving the SiC industry on its way to SiC wafer supply security

Although historical IP players (Wolfspeed, SiCrystal, II-VI) keeps filing new patents, indicating a continuous improvement of their technology, Sumitomo Electric and Showa Denko took the IP leadership in the SiC substrate patent landscape. Furthermore, the patent landscape analysis identifies numerous established IP players in the bulk SiC patent landscape, having the expertise and know-how to join in or spin off new companies in the SiC wafer business, just like SKC establishing Senic in 2021. Especially in China, there is an impressive number of IP players engaged in SiC substrate R&D, and some of them are now stand-out players in the bulk SiC patent landscape (SICC, Sinlight Crystal, TankeBlue, San’an). Eventually, the patent landscape analysis identifies the main companies engaged in the development of disruptive technologies addressing the cost and availability issues of SiC wafers (Soitec, Toyota Tsusho / Kwansei Gakuin University, Sumitomo Metal Mining / Sicoxs, Infineon / Siltectra, etc.).

Access to innovation all along the value chain as a short-cut to address timely the emerging power SiC market

While numerous companies are focusing on building a vertically-integrated supply chain to secure their SiC business in the long term, few of them have developed strong patent portfolios all along the SiC value chain, the exceptions being Toyota and Denso in Japan. Furthermore, many companies may have not anticipated Europe or China as key markets for their power SiC business, and need to strengthen their IP position in these geographic areas. Therefore, most leading companies need to combine internal innovation capabilities with external innovation sources, for instance through M&A operations (e.g., onsemi / GTAT, ST / Norstel, Wolfspeed / APEI, Danfoss / Semikron), licensing agreements (e.g., II-VI / GE) or IP collaborations (e.g., Toyota / Denso, Audi / ABB), to accelerate the deployment of their SiC technology. What’s more, a global innovation strategy is not only important in building vertically-integrated manufacturing lines, thereby cutting supplier margins and securing the supply chain internally; it also enables players to not be limited in their development by technological and cost barriers at different levels of the supply chain, from material optimization to module integration. Thus, established players holding key patents at all stages of the supply chain can expect a long-term competitive advantage in the market, while newcomers are facing particularly high barriers to entry in the SiC industry. In this regard, the patent landscape analysis describes the IP strategy of main players to enhance their access to critical technologies all along the SiC value chain.

IP profiles: focus on the top IP players’ patent portfolios

The patent portfolio of the top 10 IP players and top 6 power device market players is analyzed: Mitsubishi Electric, Sumitomo Electric, Infineon, Rohm, Toyota/Denso, Wolfspeed, Fuji Electric, Hitachi, Toshiba, STMicroelectronics, onsemi, Panasonic. For each player, we provide an overview of its strength, its potential for reinforcement and the player’s IP dynamics. The recent patenting activity of the player is then reviewed in light of recent announcements related to SiC and related challenges.

Useful Excel patent database

This report also includes an extensive Excel database with the 13,700+ patent families (inventions) analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority date, title, abstract, patent assignees, patent’s current legal status, and segments (bulk SiC, epitaxial SiC substrates, SiC diodes, planar SiC MOSFETs, trench SiC MOSFETs, SiC modules, circuits, etc.).

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Sumitomo Electric, Denso, Fuji Electric, Toyota Group, Panasonic, Infineon, Rohm, Toshiba, Hitachi, Showa Denko, Wolfspeed, Nippon Steel, Nissan, SICC, General Electric, CETC, Bridgestone, State Grid (SGCC), Shindengen Electric Manufacturing, LG Innotek, CRRC, ABB, Hyundai, Siemens, Synlight Crystal, San’an, Kansai Electric Power (KEPCO), Onsemi/GTAT, Century Goldray (CENGOL), Bosch, Sharp, Disco, POSCO, STMicroelectronics, Renesas Electronics, Sanken Electric, Shin-Etsu, Global Power Technologies, LG Chem, Kyocera, TankeBlue, II-VI, Toyo Tanso, NuFlare Technology, China Electronics Corporation (CEC), Microchip Technology, SK Siltron CSS, SKC, Meidensha Electric Manufacturing, FerroTec, BYD, Shanghai Hestia Power, EpiWorld, BASiC Semiconductor , TYSiC, Power Integrations, TUS-Semiconductor (TUS-Holdings), Daikin Industries, PN Junction Semiconductor, Mitsubishi Materials, KY Semiconductor, Sumitomo Metal Mining / SICOXS, Chongqing Wattscience Electronic Technology, LPE, Texas Instruments, Honda Motor, Danfoss, Semikron, Delta Electronics, Qorvo/United Silicon Carbide, NXP, Bright Semiconductor Technology, NAURA Technology Group, Guangzhou Summit Crystal Semiconductor (GZSC), Tokyo Electron, SENIC, Raytheon Technologies, Volkswagen group, Gree, NCE Power, YES POWERTECHNIX, Murata, FMIC – Founder Microelectronics, GlobalWafers, TsinSiC Semiconductor, AZ POWER, China SiC Power, GeneSiC Semiconductor, ZF, LG Electronics, Soitec, Cea, CISRI, Starpower, Macmic, Power Cube Semi, MapleSemi, WeEn Semiconductors, SemiQ, etc.