SOPHIA ANTIPOLIS, France – February 17, 2025 │ The lithium-ion battery market has experienced exponential growth worldwide, driven by the rising demand for electric vehicles (EVs), renewable energy storage, and portable electronics. Europe is emerging as a hub for battery innovation, fueled by substantial investments and a strong policy push for decarbonization. Europe aims to position itself as a leader in battery production, supported by government initiatives such as the European Battery Alliance and significant investments in gigafactories. Europe’s focus on sustainability and local supply chains aligns with the EU’s goal of achieving carbon neutrality by 2050.

Among cathode materials, lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) dominate the market. While LFP batteries are more affordable and thermally stable, they have a lower energy density compared to NMC batteries, making them less suitable for long-range applications. However, advancements in LFP material processing are narrowing this gap and driving its wider adoption globally. China leads in LFP adoption, with major players like CATL, BYD, and EVE Energy spearheading production and innovation. In Europe, NMC cathodes remain dominant due to their superior energy density and suitability for high-performance EVs. However, LFP is gaining traction in the region thanks to its cost-effectiveness and safety advantages.

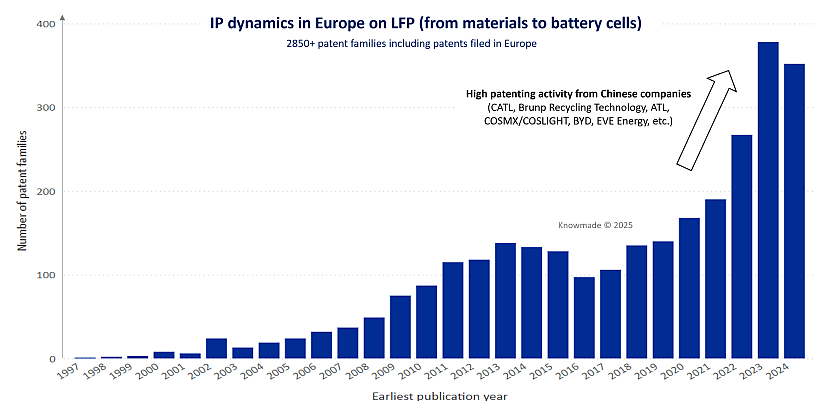

Booming Patenting Activity on LFP in Europe Since 2020

Today, the LFP patent corpus in Europe comprises over 2,850 patent families (inventions). In such a dense and rapidly evolving landscape, it is crucial to monitor competitors’ moves and secure a strong IP position.

“Patent landscape analysis is the perfect complement to market research, providing a comprehensive understanding of the competitive landscape and technology roadmap. It helps businesses stay ahead of cutting-edge developments, anticipate future technology adoption, and analyze competitors’ strategies. This type of patent landscape report uncovers companies, technical solutions, and strategies that standard market analysis might overlook,” states Fleur Thissandier, PhD, Senior Technology and Patent Analyst for Batteries & Materials at KnowMade.

LFP-related patent activity in Europe has surged since 2020, largely driven by Chinese companies such as CATL, Brunp Recycling Technology, ATL, and BYD. The strengthening of their intellectual property (IP) position confirms Chinese companies’ strategic push into the European market. This trend aligns with their efforts to establish a robust battery supply chain in Europe.

Figure 1: Time evolution of patent publications in Europe related to LFP batteries (incl. LFP materials and LFP-based battery cells).

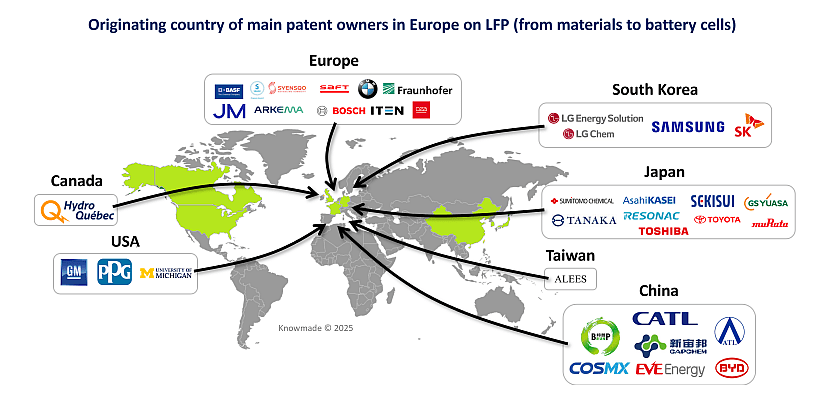

Worldwide Origins of Key IP Players in the LFP Supply Chain in Europe

Key players holding LFP-related patents in Europe come not only from Europe but also from various foreign regions, including the USA, Canada, China, South Korea, and Japan. This distribution highlights the global interest in Europe’s LFP ecosystem. While European, North American, Japanese, and South Korean entities contribute to European LFP patenting activities — with LG, Hydro-Québec, and Sumitomo Metal Mining having the most established IP portfolios — Chinese entities dominate the European LFP patent landscape, demonstrating their proactive approach to securing their IP position and controlling the supply chain.

Figure 2: Originating country of the main patent assignees for patents filed in Europe related to LFP (incl. LFP materials and LFP-based battery cells).

Recently, three major patent portfolio acquisitions including numerous European alive LFP-related patents happened:

- In 2022, Sumitomo Osaka Cement (SOC) transferred its LFP battery materials division to Sumitomo Metal Mining (SMM), including the battery materials research group at the New Technology Research Institute and its subsidiary, SOC Vietnam. Sumitomo Osaka Cement had been developing LFP battery materials using original nanoparticle synthesis technology since the 1980s. In 2012, the company completed the construction of a mass production plant in Vietnam and has since supplied the market with high-performance, stable-quality LFP battery materials. This strategic acquisition strengthens Sumitomo Metal Mining’s position in the battery materials market and grants it access to numerous LFP-related patents enforceable in Europe.

- In 2021, Johnson Matthey decided to exit the battery materials sector, concluding that the potential returns did not justify the necessary investments. The company then began selling or shutting down its operations in this field. In 2023, Johnson Matthey transferred several patents to Epsilon Advanced Materials, an Indian company established in 2018 as a subsidiary of Epsilon Carbon, focusing on the development and production of advanced battery materials, particularly anode and cathode materials for lithium-ion batteries. The following year, Epsilon Advanced Materials completed the acquisition of an LFP cathode active materials technology center in Moosburg, Germany, previously owned by Johnson Matthey. This acquisition aims to strengthen the position of Epsilon Advanced Materials as a global supplier of battery materials for electric vehicles, with the goal of reducing the battery market’s dependence on China. It is worth noting that some LFP-related European patents remain assigned to Johnson Matthey.

- In 2022, Reliance New Energy, a subsidiary of the Indian conglomerate Reliance Industries, acquired nearly all the assets of Lithium Werks. This acquisition included Lithium Werks’ entire patent portfolio—including numerous LFP-related patents enforceable in Europe—manufacturing facilities in China, and key commercial contracts. Lithium Werks had previously acquired Valence Technology in 2018, gaining customer relationships, global manufacturing, sales and distribution sites, as well as intellectual property related to LFP. Following its acquisition by Reliance, Lithium Werks ceased to exist as an independent entity, and its operations, including those related to battery materials, were integrated into Reliance New Energy.

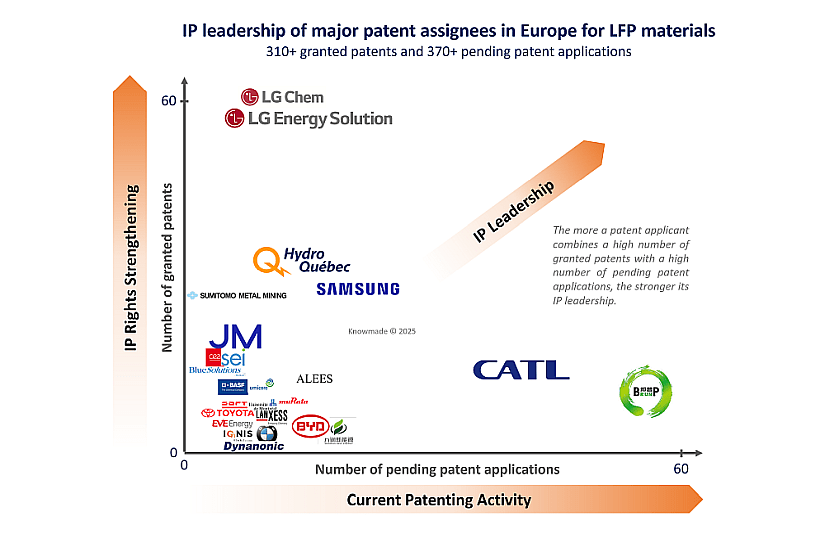

Foreign Companies Lead he LFP Materials Patent Landscape in Europe

“The analysis of both granted patents and pending applications in Europe provides valuable insights into the enforceability of IP portfolios and the current level of patent activity of major IP players in this region. The more a company combines a high number of granted patents with a high number of pending applications, the stronger its IP leadership,” explains Fleur Thissandier, PhD.

LG is an established IP player for LFP materials, holding the highest number of granted patents but a relatively low number of pending patent applications. In fact, it primarily filed patents between 2010 and 2019. Meanwhile, Brunp and CATL have emerged as IP challengers, significantly increasing their LFP material-related patent activity after 2021. Samsung and Hydro-Québec also have notable IP positions, with Samsung experiencing a significant surge in 2024. Hydro-Québec has maintained steady patent activity since 2007, focusing on incremental advancements in LFP materials.

Sumitomo Metal Mining’s 2022 acquisition of patents from Sumitomo Osaka Cement underscores its strategic focus on advanced cathode technologies and strengthens its LFP patent portfolio in Europe. Despite its decision to exit the cathode materials business, Johnson Matthey still holds LFP-related patents in Europe. These patents cover aluminum doping, control of crystallite physical properties (size, BET surface area, morphology), carbon coating, aqueous synthesis processes, material purity control, and a wide range of manufacturing processes, including solid-state, hydrothermal, and high-energy milling.

Figure 3: Number of granted patents and pending patent applications held by major IP players in Europe for LFP materials.

The European patent portfolios of major IP players in LFP-based battery materials demonstrate a strong focus on overcoming LFP’s intrinsic limitations (low electronic conductivity and moderate energy density), while maintaining its high thermal stability, long cycle life, and cost-effectiveness. Innovations span both material design and processing techniques, ensuring a competitive edge in electric vehicle (EV) and energy storage system (ESS) applications.

LG’s European patents on LFP materials disclose various material compositions and manufacturing methods, particularly the synthesis of LFP nanopowders with specific physical properties via hydrothermal processes, surface coating with Carbon, LFP material doping, and the reduction of residual lithium salt impurities.

Samsung‘s European patents in LFP battery materials focus on composite cathode materials incorporating NMC or LMFP in addition to LFP, nanostructured coatings (such as graphene, CNTs, metal oxides, LiF, and phosphate-based materials), advanced doping techniques, and optimized manufacturing processes (including sol-gel and solvothermal/hydrothermal methods).

CATL’s European patent portfolio in LFP materials encompasses a wide range of innovations, including core-shell structures, doped LFP materials, composite materials combined with polyanionic compounds, transition metal oxides, or carbonaceous materials, as well as advanced hydrothermal/solvothermal manufacturing techniques.

The European patent portfolio held by Sumitomo Metal Mining covers various aspects of LFP cathode materials, focusing on optimizing particle morphology, carbon and phosphate coatings, the addition of doping elements, and refining key manufacturing steps such as calcination, mixing, granulation, and coating.

The European patents of Hydro-Québec in LFP materials emphasize several improvements, including processes for regenerating electrode materials through alkaliation/re-alkaliation, polymer- and/or carbon-based coating materials, and composites incorporating oxide-based materials.

Brunp’s European patent portfolio specializes in doping LFP materials, encapsulating LFP materials with carbon or metal oxides, and developing advanced recycling processes for recovering and reusing LFP materials.

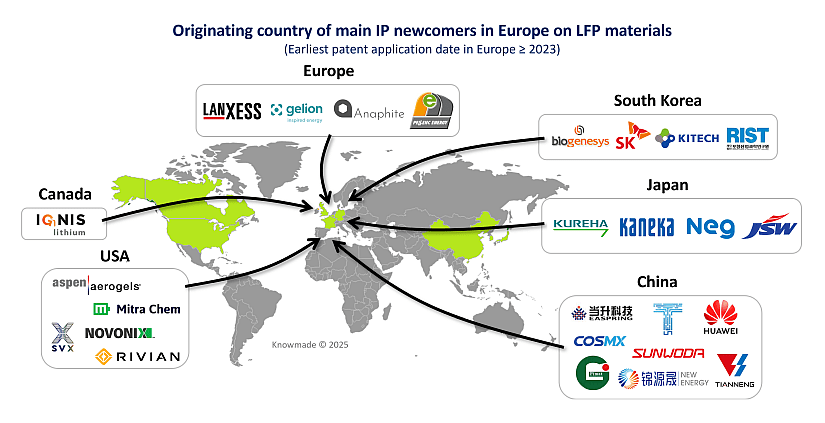

Emerging Players in Europe’s LFP Material Patent Landscape

Since 2022, more than 40 new players have entered the LFP materials patent landscape in Europe. Among them, several companies are startups or pure players in the field.

Figure 4: Originating country of the main IP newcomers in Europe on LFP materials (i.e., first LFP material-related patent filed in Europe in 2023 or later).

Rivian is an American electric vehicle manufacturer founded in 2009. In 2021, Rivian announced plans to develop its own battery cell manufacturing. The company holds 4 patent families (inventions) focused on LFP materials and their manufacturing methods, including production from recycled battery black mass (patent DE102023122661), coating with protective hydrophobic materials (patent DE102023113358), and synthesis techniques to monitor particle size, morphology, and packing density (patents DE102023112015, DE102023116918).

Novonix was founded in 2013 as a spin-out from Dalhousie University (USA). The company is actively involved in the development and manufacturing of synthetic graphite, as well as the exploration and mining of natural graphite. Its PCT patent application WO2024102624 (European countries as designated states) claims a method for producing free particles via dry mechanofusing of feedstock and template particles, followed by impact milling. These particles can contain LFP and/or NMC and be used as battery cathode materials.

Sylvatex is an American materials manufacturer founded in 2007. The company focuses on developing innovative methods to produce cathode active materials (CAM) that are both cost-effective and environmentally friendly. Sylvatex has developed a proprietary waterless, continuous synthesis process for producing CAM, particularly targeting LFP and NMC chemistries. Its patent application EP4441823 covers this invention.

Mitra Chem is an American materials manufacturer founded in 2021. The company specializes in the development and production of advanced lithium-ion battery materials, with a focus on iron-based cathode materials such as LFP. In September 2024, Mitra Chem announced a joint development agreement with Sun Chemical to co-locate iron phosphate and LFP production in the United States. Its PCT patent application WO202406952 (European countries as designated states) claims a lithium metal polyanion utilizing a blend of PO₄ and SiO₄ anions.

Ignis Lithium is a Canadian materials manufacturer founded in 2022. The company pioneers a melt-synthesis process for scalable LFP and LMFP production. Its PCT patent applications with European countries as designated states cover this process (WO2024148421, WO2024148427, WO2024148417).

Anaphite is a materials manufacturer founded in 2016 and based in Bristol, UK. The company develops enhanced cathode powders for low-cost, high-performance lithium-ion batteries. Its carbon nanotube-enhanced LFP and NMC formulations are designed to support decarbonization and simplified production processes. Its PCT patent application WO2024165861 (European countries as designated states) claims a process for fabricating composite materials comprising an electrode active material, a polymeric binder, and a conductive material.

Gelion Technology, established in 2015 as a spin-off from the University of Sydney, has a parent company in the UK. The company focuses on developing next-generation battery technologies, such as zinc-bromine (Zn-Br) and lithium-sulfur (Li-S) batteries. Gelion acquired Johnson Matthey’s Li-S battery patent portfolio and OXLiD in 2023. Its patent EP4385088 claims a catholyte that can include lithium metal phosphate as an active material, originally filed by Johnson Matthey.

BioGeneSys is a South Korean materials manufacturer founded in 2020. It specializes in hybrid graphene sensor technology and AI-driven precision measuring systems. Its innovations contribute to enhanced battery diagnostics and efficiency. Its PCT patent applications with European countries as designated states (WO2024071576, WO2024071575) claim hybrid graphene composite particles containing battery active materials, notably LFP.

Jayson New Energy is a Chinese company founded in 2017, specializing in the development, smelting, and deep processing of energy metal mineral resources, as well as the production of lithium-ion battery cathode precursor materials. Its PCT patent application with European countries as designated states (WO2024104075) claims a phosphate precursor and its use in LFP production.

Keep an Eye on Global Battery Patent Landscape is Crucial

The European LFP market, historically overshadowed by NMC dominance, is undergoing significant transformation, driven by both global players and local patented innovations. The surge in LFP-related patent activity in Europe since 2020 underscores the increasing strategic importance of LFP battery chemistry. Major acquisitions and evolving IP strategies indicate that LFP technology is advancing, with new startups and Asian companies reshaping the European IP landscape. Chinese companies such as CATL, Brunp Recycling, ATL, and BYD are filing numerous LFP patents in Europe, signaling their strategic expansion into the European market. The ongoing patenting activity reflects the market’s competitive nature, where protecting key inventions is essential for securing a technological edge.

Patent activity in the battery sector is thriving and remains highly attractive across the entire supply chain, particularly in key areas such as NMC and LFP cathodes, silicon anodes, and solid-state batteries. In this fast-evolving and highly competitive environment, gaining a deep understanding of the patent ecosystem and the strategies of industry players is becoming increasingly crucial.

To address this need, KnowMade publishes in-depth reports and offers monitoring services to track and analyze competitors’ R&D and intellectual property strategies. These insights help identify the focus areas of industry leaders, emerging players, and startups, providing an early perspective on their strategic direction, technological investments, and product development efforts.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Fleur Thissandier, PhD, works at Knowmade as Senior Analyst in the field of Materials Chemistry and Energy storage. She holds a PhD in Materials Chemistry and Electrochemistry from CEA/INAC, (Grenoble, France), and a Chemistry Engineering Degree from the Superior National School of Chemistry (ENSCM Montpellier, France). Fleur previously worked in battery industry as R&D Engineer.

About Knowmade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand the competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.