SOPHIA ANTIPOLIS, France – July 29, 2022 │ Toyota were one of the first companies to put an electrical vehicle, the EV-RAV4, on the market in the late 1990s. The EV-RAV4 was equipped with Ni-MH batteries provided by Panasonic. Unfortunately, this Toyota electric vehicle battery used a patent held by GM Ovonics/Texaco. Toyota and Panasonic were sued for patent infringement resulting notably in the restriction of the number of EVs commercialized by Toyota. Since this period, Toyota seems more reluctant to venture into the full electric vehicle market, mainly commercializing hybrid vehicles instead. New rules and regulations on vehicle CO2 emissions are forcing car manufacturers to accelerate their transition towards electric vehicles. Toyota is following the trend and starting to commercialize full electric vehicles for the mainstream market. Electric vehicle performances (autonomy, speed, safety) mainly rely on batteries. That’s why car manufacturers are investing heavily in the battery field, either by improving their own R&D and intellectual property (IP) developments, by collaborating with leading material suppliers and battery manufacturers, or by investing in promising start-ups operating on new battery technologies. Today, battery manufacturers from Korea (LG, Samsung), Japan (Murata/Sony, Panasonic) and China (CATL, BYD) lead the battery patent landscape. More and more Chinese companies and R&D labs are filing patents on batteries. Europe has attracted strong interest from battery manufacturers in the last five years thanks to strong market growth induced by the advent of electrical vehicles. The main battery manufacturers are building gigafactories in Europe. New battery manufacturers are also incorporated in Europe (Northvolt, ACC, Verkor, Britishvolt, Itavolt, Basquevolt, Beyonder, Freyr, etc.), most of the time in partnership with car manufacturers. Toyota has a triptych IP strategy on batteries to conquer the EV market: vertical innovation, worldwide geographic coverage and high technological coverage on present and future technologies. Read on for in-depth analysis of this Toyota EV battery strategy.

Through KnowMade’s comprehensive IP strategy analysis on Toyota, performed by our team of analysts, discover what the Japanese company is preparing in the electric vehicle sector. To learn more about Toyota’s overall strategy with KnowMade’s analytical expertise, follow these links:

- Hydrogen-based Fuel Cell Electric Vehicles: a winning bet for Toyota?

- The vertical innovation path: from material to power devices and their integration in electric vehicles (EV)

- Toyota Group, a leading IP player in the development of sensors and autonomous vehicles technologies

Toyota anticipated the move toward hybrid and electrical vehicles before it became a market target

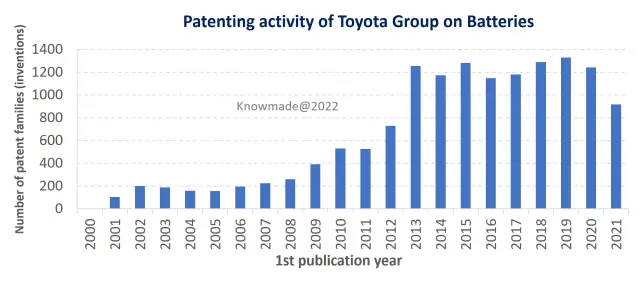

Toyota learned the importance of securing its IP related to batteries the hard way. And that is in turn reflected in its IP strategy in the battery field. In the early 2000s, Toyota made the choice to develop its R&D on batteries in-house and through collaborations and to secure related IP. In the late 2000s, the attraction for electrical and hybrid vehicles strongly increased. Toyota followed the trend and accelerated its patenting activity on batteries before stabilizing it at a high level between 2012 and the COVID-19 crisis of 2020-2021. During this period, Toyota mainly increased its patenting activity related to Li-ion batteries and generic battery cells and packs (multi-technos). It also explored and filed patents on most emerging battery technologies (Li-S, Li-Air, Na-ion, Mg-ion, F-ion, etc.) which could result in electrical vehicles with better performance (higher autonomy, speed, safety, etc.). Over the years, the Toyota EV battery patent portfolio has swollen considerably (15,000+ patented inventions). Toyota secured its IP position along the whole supply chain, from electrode active materials and electrolytes to battery cells and packs.

Figure 1: Time Evolution of Toyota Group’s patent family publications related to batteries.

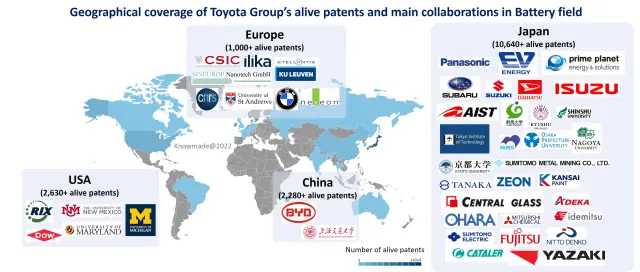

Toyota teams up with other companies and R&D labs worldwide

Toyota doesn’t go it alone in the battery ecosystem. Toyota founded several joint ventures with Panasonic, i.e. Primearth EV Energy in 1996, specialized in Ni-MH batteries; and Prime Planet Energy & Solutions (PPES) in 2020, specialized in Li-ion batteries. Toyota and Panasonic have 160+ co-filed patents, mainly on electrodes, battery cells and packs. Since 2018, the company also established joint ventures with other vehicle manufacturers (BYD, Group PSA/Stellantis, Subaru, Suzuki/Daihatsu, Isuzu). Moreover, Toyota has IP collaborations with 300+ companies and R&D labs mainly from Japan.

Figure 2: Geographical coverage of Toyota Group’s alive patents and main collaborations in the battery field.

Toyota has a strong collaboration network in the Japanese battery ecosystem. It is involved in a consortium of Japanese companies with a common technology platform founded in 2010 for the evaluation and analysis of new battery materials (LIBTEC). Toyota draws on the expertise of numerous Japanese R&D labs to complement its know-how in active materials (AIST, Gunma University, Kyushu University, Shinshu University), solid electrolytes (Tokyo Institute of Technology, NIMS, Osaka Prefecture University), liquid electrolytes (Shizuoka University, University of Tokyo, Osaka University, Nagoya University) and emerging battery technologies (F-ion with Kyoto University, Li-S with AIST). Toyota also secures its battery composition and corresponding future supply by means of IP collaborations with companies producing electrode active materials (Sumitomo Metal Mining, Tanaka, etc.), binders and polymers (Zeon, Kansai Paint, etc.), liquid or solid electrolyte components (Central Glass, Adeka, Idemitsu Kosan, Ohara, Mitsubishi Chemical, etc.), separators (Nitto Denko) and other components for battery cells and modules (Sumitomo Electric Industries, Fujitsu, Yazaki, etc.).

Toyota is also building its collaboration network outside Japan. The company notably has IP collaborations on electrode manufacturing with RIX Industries and Ilika Technologies, new active materials with Dow, Sineurop Nanotech and University of New Mexico, new electrolyte materials with University of Maryland, CNRS and Katholieke Universitet Leuven and emerging battery technologies such as the Ca-ion battery with CSIC and metal-air batteries with BMW, University of St Andrews and University of Michigan. In 2021, Toyota/Panasonic joint venture PPES also announced a key partnership and investment with Nexeon, a British start-up specialized in silicon anodes. This collaboration strategy reflects Toyota’s geographical patenting activity: filing patents worldwide with a strong focus on Japan.

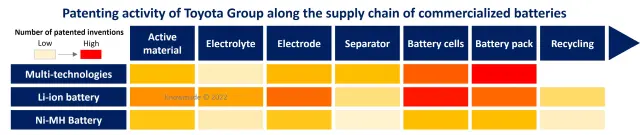

Toyota shows strong patenting activity along the whole supply chain of batteries used in HEVs and EVs

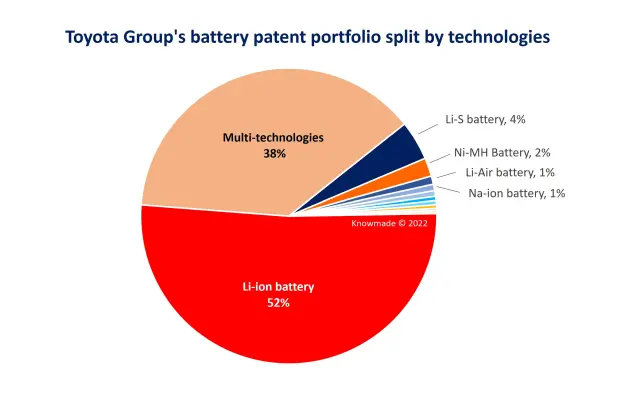

Most of Toyota’s patent portfolio is dedicated to battery technologies currently used in hybrid and electrical vehicles (Ni-MH batteries, Li-ion batteries). About 40% of Toyota’s patents are not focused on a specific battery technology. Most of these patents claim battery cells or packs that can be used for different battery technologies. By adopting this strategy, the company maintains its capacity to switch between battery technologies in battery cells and modules with a limited decrease of its IP protection.

Figure 3: Main Toyota EV battery technologies patented, by number of patent families.

Toyota displays weak patenting activity related to old battery technologies such as lead-acid batteries and alkaline batteries. Surprisingly, Toyota has a relatively low number of patents on Ni-MH batteries (300 patented inventions across the whole supply chain) in its patent portfolio. Toyota uses Ni-MH batteries in its commercialized hybrid vehicles. After slowing down its patenting activity between 2006 and 2012, Toyota has increased it again on Ni-MH battery cells and packs and has filed a notable number of patents per year over the last few years. On the contrary, 51% of Toyota’s patent portfolio is related to Li-ion batteries, the main (if not the only) battery technology used in electrical vehicles. Most of Toyota’s patents related to Li-ion battery cells and packs do not specify the anode and cathode materials.

Toyota shows a strong willingness to be involved in the evolution of batteries with improved performances, from the development of active and electrolyte materials to the manufacturing and composition of battery cells and packs. Toyota has a vertical innovation strategy: it files patents on the whole supply chain for the main commercialized battery technologies (Ni-MH, Li-ion battery). Thanks to this strategy, it can control and secure its IP for each material, component and manufacturing process for the battery cells and packs that will be used in its vehicles. Toyota only has a few patents related to battery recycling. However, it seems to file patents more regularly on this topic since 2015. In 2022, Toyota signed partnerships on battery recycling with Redwood Materials and Jera.

Figure 4: Toyota electric vehicle battery patenting activity along the supply chain, for the main commercialized battery technologies, based on the number of patented inventions.

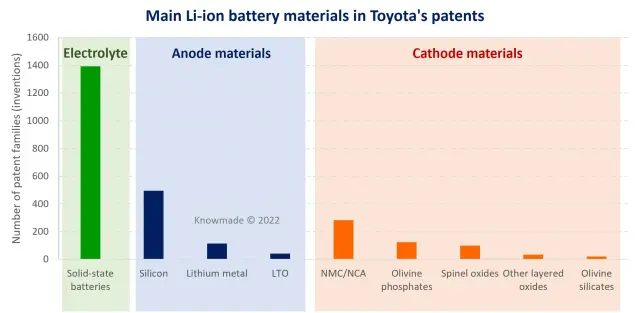

Nowadays, the aim of Li-ion battery R&D players is to improve battery safety, charging speed, energy and power densities to get safe electrical vehicles that are quickly rechargeable with greater autonomy and power. Several anode, cathode and electrolyte materials have been developed to reach this goal.

Figure 5: Main Lithium-ion battery materials featuring in Toyota’s patents, by number of patent families.

Toyota is a key IP player for promising and emerging battery technologies

Toyota is developing its patent portfolio in the most promising anode material: silicon

On the anode side, Toyota holds patents on the three main materials envisioned to replace graphite in the next generation of Li-ion batteries: i.e., silicon, lithium metal and lithium titanate (LTO / Li4Ti5O12). Silicon is the most promising anode material to improve battery performances (energy density, capacity, environmental friendliness, etc.). For the last ten years, Toyota has mainly focused its anode R&D developments on silicon (490+ patented inventions). Toyota is among the Top 5 main patent applicants in the silicon anode patent landscape behind major battery manufacturers (Panasonic/Sanyo, LG Chem/LG Energy Solution, Murata/Sony and Samsung).

Figure 6: Ranking of main patent assignees in the silicon anode patent landscape, by number of patented inventions.

Toyota patented several material compositions and structures to overcome the two major drawbacks of silicon anodes, i.e., poor cyclability due to the high-volume expansion of silicon, leading to huge stress generation during charge/discharge and mechanical collapsing of the electrodes, as well as the poor intrinsic electronic conductivity of silicon. Toyota’s recent patents on silicon anode materials describe various silicon composites with different compositions (Si/metal silicide (TiSi2, etc.), Si@Carbon@Polymer), pure silicon fibers and porous silicon and corresponding manufacturing methods.

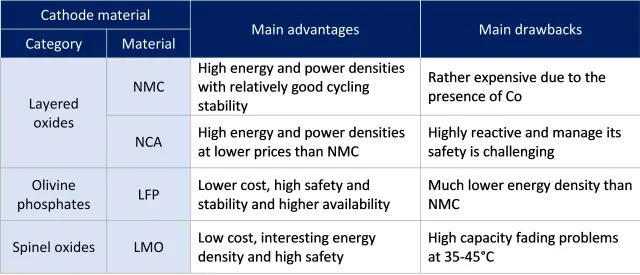

Toyota has patents on commercialized and emerging cathode materials for

Li-ion batteries

On the cathode side, Toyota not only has patents on the current in-demand materials (NMC/NCA, LFP), but also on emerging materials (olivine silicates/phosphates). NMC, NCA, LFP and LMO are the main cathode materials currently used in commercialized Li-ion batteries. Each of them has advantages and drawbacks (Figure 7). NMC is the most in-demand material used in a wide range of applications. LFP (olivine phosphate) is widely used in batteries commercialized in China, and recently regained the interest of battery manufacturers from other countries due to its lower cost, high safety and stability and greater availability. Lithium metal silicates and other olivine phosphates show promising improvements in terms of energy density, safety and operating voltage. However, their cycling stability and rate capability have still to be enhanced before they can be introduced in commercialized batteries.

Toyota explored several cathode material technologies with different patenting activity peaks down the years (2007-2011 for olivine phosphates, 2010-2015 for olivine silicates, 2009-2016 for spinel oxides). Over the last five years, it has continuously increased its patenting activity on NMC/NCA (started in 2011). Most of Toyota’s patents on olivine silicates have been filed in collaboration with another IP player (AIST, Tohoku University and Sumitomo Metal Mining).

Figure 7: Main advantages and drawbacks of major cathode materials used in commercialized Li-ion batteries.

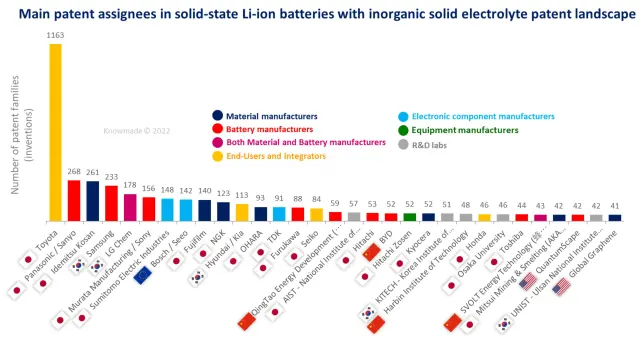

Toyota: IP leader in the solid-state Li-ion battery patent landscape

Since 2008, Toyota has displayed strong patenting activity related to solid-state batteries (about 1,400 patented inventions). In a solid-state battery, the flammable liquid electrolyte used in a conventional Li-ion battery is replaced by a solid-state electrolyte, which results in greater safety and enhanced battery characteristics. Solid-state batteries hold a key position in the booming developments to get safer Li-ion batteries with higher energy density and fast charging capability for electric and hybrid electric vehicles (EV/HEV). Toyota is today by far the most important patent assignee on solid-state batteries with the strongest IP position along the whole supply chain: electrolyte materials, electrodes, battery cells (see KnowMade’s last patent landscape report on solid-state batteries). Inorganic sulfide electrolytes are the main solid electrolyte disclosed in Toyota’s patents. The company also has patents related to the two other most in-demand inorganic oxide solid electrolyte materials (Garnet and NASICON).

Figure 8: Ranking of main patent assignees in the solid-state battery patent landscape by number of patented inventions.

Today, the solid-state battery patent corpus includes more than 12,000 patent families (inventions), of which more than 520 published in the first quarter of 2022 alone. In such a dense and dynamic landscape, it is important to be aware of how the competitors move, and secure one’s IP position. All year long, KnowMade’s analysts investigate patenting activities related to solid-state batteries through a dedicated Quarterly Patent Monitor. “Thanks to the patent monitor, we have noticed that Toyota recently started filing patents on new solid electrolyte materials showing promising performances, such as oxysulfides, nitrides, phosphates, fluorides, halides, etc.”, says Fleur Thissandier, PhD, Technology and Patent Analyst Batteries & Materials at KnowMade.

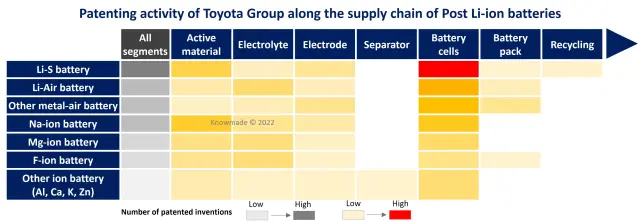

Toyota keeps one step ahead of its competitors by filing patents on post-Li-ion battery candidates

Toyota not only files patents on battery technologies currently used in hybrid and electrical vehicles, but also on emerging technologies hoped to surpass Li-ion battery performances.

The Li-S battery is the main post-Li-ion battery technology developed by Toyota (600+ patented inventions). Li-S batteries have the advantage of reaching high specific energy density, using light, abundant and cheap materials and having a higher tolerance to overdischarge. However, they suffer from safety concerns due to the use of a lithium metal electrode as well as cycling and self-discharge stability issues due to the progressive leakage of sulfur active material from the cathode. The technology development is at prototype level. Toyota increased its patenting activity on Li-S batteries in the late 2000s and has stabilized it at 50+ new patented inventions per year since 2015. Most of Toyota’s patents on Li-S batteries are related to the composition and manufacturing of the battery cell. The company also filed some patents on sulfur active materials and electrodes.

Since 2008, Toyota has capitalized on the know-how in air electrodes gained during its development of fuel cells to build its patent portfolio on Li-air/metal-air batteries (200+ patented inventions). However, Toyota has decreased its patenting activity on Li-air/metal-air batteries over the last five years. Li-air batteries have high theoretical energy density but lower weight. However, their power density, cycling stability and safety need significant improvements before they can be commercialized. These major drawbacks have led to a decline in interest in this technology over the last few years.

Figure 9: Matrix: post-Li-ion battery technologies vs. supply chain segments according to the number of patent families in Toyota Group’s patent portfolio.

Since 2010, Toyota has built up a small patent portfolio on Na-ion batteries (100+ patented inventions) and Mg-ion batteries (60+ patented inventions as shown in KnowMade’s report), covering the whole supply chain but with a special focus on active materials, electrolytes and battery cells. The Na-ion battery is the post-Li-ion battery closest to commercialization. Prototypes are currently tested in real use conditions. The Na-ion working principle and cell construction are similar to Li-ion batteries, thus the same production line could be used for both technologies. Compared to Li-ion batteries, Na-ion batteries are safer and cheaper but have lower cell voltage and energy density. These drawbacks should be overcome to reach high market adoption. Mg-ion technology is still at laboratory development stage (an active research topic). The technology is still far from maturity, but shows promising performances (higher volumetric energy density, lower cost, higher safety). The remaining challenges are the development of cathode materials with higher Mg2+ ion mobility and the difficulty of finding electrolytes that are less corrosive, volatile and with higher ionic conductivity.

Over the last five years, Toyota has filed patents on F-ion batteries, covering the whole supply chain. One third of these patents have been co-filed with Kyoto University. The F-ion battery is a new promising battery technology in the early stages of development. In theory, the F-ion battery has higher volumetric energy density, a wide electrochemical stability window due to very stable F-ion and fluorine abundance. However, major developments are necessary for electrode active materials and electrolytes to reach higher cyclability, conductivities, rate capability, safety, and operation at room temperature.

Toyota also files patents on very recent emerging battery technologies such as Al-ion, Ca-ion, K-ion, and Zn-ion batteries. These technologies have high theoretical energy and power densities and low expected price. Their operating voltage, lifetime and rechargeability have to be improved for the

proof-of-concepts to advance.

Toyota EV battery patent portfolio means it holds all the cards to successfully manage the transition towards EVs

The battery is one of the key components influencing electric vehicle performances (autonomy, speed, safety). Toyota has recently started to commercialize electric vehicles. However, it has been developing its patent portfolio on batteries for several decades as if the electric vehicle market is its target. Toyota has a broad and diversified patent portfolio on batteries, covering the whole supply chain, and current and future technologies. The company has developed a dense collaboration network on batteries in Japan and abroad and secured its IP position in key production and commercialization regions for batteries and electric vehicles (Japan, Korea, China, Europe, the US). On the other hand, Toyota also has a broad patent portfolio on hydrogen fuel cells. Let’s see in the future which of Toyota’s technologies will take the lead.

All our patent landscape reports on batteries.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Fleur Thissandier, PhD, Fleur works for Knowmade in the field of Materials Chemistry and Energy storage. She holds a PhD in Materials Chemistry and Electrochemistry from CEA/INAC, (Grenoble, France). She also holds a Chemistry Engineering Degree from the Superior National School of Chemistry (ENSCM Montpellier, France). Fleur previously worked in battery industry as R&D Engineer.

Arnaud Capgras, Arnaud works for Knowmade in the field of Materials Chemistry and Energy storage. He holds a Chemistry-Process Engineering Degree from the Chemistry and Chemical Engineering School of Lyon (CPE Lyon, France). He also holds the International Industrial Property Studies Diploma (Patents) from the CEIPI (Strasbourg, France).

About Knowmade

Knowmade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

Knowmade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

Knowmade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.