SOPHIA ANTIPOLIS, France – November 15, 2021 | Driven by the rush to get electrical vehicles with greater autonomy and power, R&D developments in the battery field are constantly increasing and multiplying. Solid-state lithium-ion (Li-ion) batteries with inorganic solid electrolytes hold a key position in the booming developments to get safer Li-ion batteries with higher energy density and fast charging capability for electric and hybrid electric vehicles (EV/HEV). In a solid-state battery, the flammable liquid-electrolyte used in a conventional Li-ion battery is replaced by a solid-state electrolyte, which results in greater safety and enhanced battery characteristics. However, manufacturing processes and materials used for batteries with liquid/gelled electrolytes or thin-film solid-state batteries are not directly applicable for large-scale (‘bulk’) solid-state batteries. Therefore, new processes and materials must be developed to get large-scale solid-state batteries up to market requirements in terms of performance, stability and cost. There are currently three main axes for development to enhance bulk solid-state battery performance: improve solid electrolyte performance; improve the electrode/electrolyte interface; and develop material/cell assembly manufacturing processes compatible with industrial production. Many companies have recently presented solid-state battery prototypes and announced their commercialization and integration in electric vehicles by 2025. What can the patents tell us about the position of the different players involved in the field? Solid-state battery related patents were analyzed in Knowmade’s Solid-State Li-ion Batteries with Inorganic Solid Electrolytes patent landscape report released in October 2021. Japanese companies have dominated the solid-state Li-ion battery patent landscapes, but the last 3 years have seen an explosion in Chinese patenting activity, while automakers and numerous pure-play newcomers are entering the game. Will Japanese companies maintain their lead in the intellectual property (IP) landscape to win the race on solid-state batteries?

“Patent landscape analysis is the perfect complement to market research, to fully comprehend the competitive landscape and technology roadmap, keep abreast of cutting-edge technology developments, anticipate future technology adoption, and understand the different competitors’ strategies. Patent landscape analysis reveals the companies, technical solutions and strategies not identified through standard market analysis,” affirms Fleur Thissandier, PhD, Technology and Patent Analyst Batteries & Materials at Knowmade.

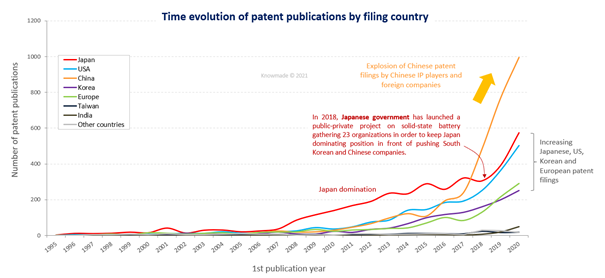

Figure 1: Time evolution of patent publications by filing countries for inorganic electrolyte-based solid-state lithium-ion batteries.

“Inorganic electrolyte-based solid-state lithium-ion batteries represent a thriving patent landscape, involving more than 7,300 inventions from more than 1,000 different entities,” says Fleur Thissandier. Japanese companies dominated the solid-state Li-ion battery patent landscape until 2017. However, the last 3 years have seen an explosion in Chinese patenting activity, mainly due to the entry of numerous Chinese research organizations and companies such as QingTao Energy, SVOLT, COSMX, CATL, Zhejiang Funlithium New Energy (subsidiary of Ganfeng Lithium), Tianmu Energy Anode Material, New Keli Chemical, Lishen, Seres/SF Motors (subsidiary of Sokon), Baochuang/Bootory (R&D base of Baoneng Group), BOE Technology, China Lithium Battery Technology (CALB), SAIC Motor, RUISAIDE Energy Technology, WeLion New Energy, etc. The other noteworthy IP newcomers are American Solid Power, Storedot, Blue Current and IBM, the Japanese Showa Denko, JX Holdings, Taiheiyo Cement, SOKEN and Power IV, and the European Volkswagen, Renault and Vitesco Technologies.

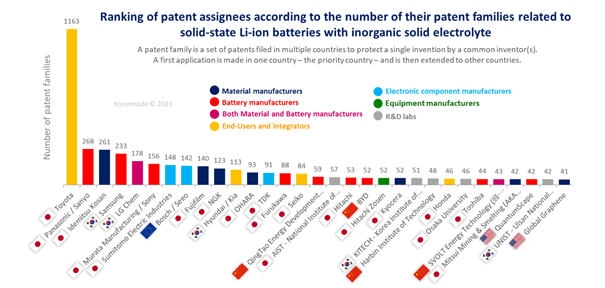

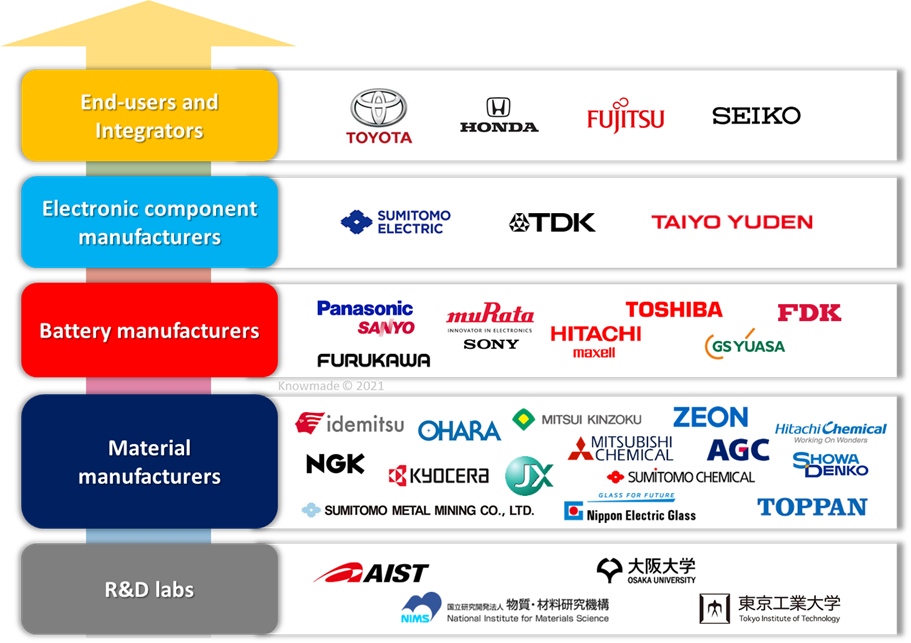

Japanese companies entered the patent landscape at different periods and display distinct IP dynamics today. Some of them started filing patents at the early age of the technology. NGK, Hitachi and Toshiba still exhibit a small patenting activity, while Panasonic/Sanyo, Murata/Sony and GS Yuasa have increased theirs over the last 3 years. Other Japanese IP players then arrived, such as Fujifilm, Mitsui, TDK, Furukawa and FDK, which recently increased their patenting activity. By contrast, Idemitsu Kosan and Ohara have slowed down their IP activity while Sumitomo Electric Industries and Kyocera have stopped filing patents since 2013 and 2016 respectively. Toyota and Honda are the two main Japanese car manufacturers present in the inorganic electrolyte-based solid-state Li-ion battery patent landscape. Toyota started filing patents in the mid-2000s, has strongly increased its patenting activity since 2010, and is today by far the most important patent assignee in the field. Honda entered the IP landscape more recently in 2014, and just strongly reactivated its IP activity in the last two years.

Figure 2: Main patent assignees in the inorganic electrolyte-based solid-state Li-ion battery patent landscape.

In a highly dynamic and competitive environment, the patent landscape is still quantitatively dominated by Japanese companies from all over the value chain. Japanese entities own the great majority of enforceable Japanese patents, and remain the main applicants for current pending patent applications as well. However, most Japanese players have a global IP strategy with numerous patents and pending patent applications held in key foreign countries, clearly indicating their willingness to target the worldwide market. In 2018, the Japanese government launched a public-private solid-state battery project bringing together 23 organizations (LiBTEC) in order to keep Japan in pole position ahead of rising South Korean and Chinese companies. This initiative has led to a strong increase in patenting activity in Japan since 2019. The aim of this initiative is also to reinforce the existing strong collaboration network between solid-state battery players. Japanese companies and research organizations have numerous co-owned patents, indicating a strong collaboration network. Toyota has notably co-filed patents with the National Institute of Advanced Industrial Science and Technology (AIST), Idemitsu Kosan, Ohara, Tokyo Institute of Technology and Osaka University. AIST co-owns patents with Denka, Toda Kogyo, GS Yuasa, Hitachi and Idemitsu Kosan. Other notable IP collaborations are Idemitsu Kosan/Hitachi, Ohara/Seiko, NGK/Kyushu University/Tokyo Metropolitan University.

Japanese companies have also secured their position all along the value chain from both a market and patent point of view. Automakers and battery manufacturers not only hold patents relating to electrodes and battery cells, but also to electrolyte materials. In fact, they have R&D departments dedicated to new battery material development and evaluation, and collaborations with research organizations specialized in electrolyte and electrode materials. Similarly, material manufacturers not only hold patents relating to electrolyte materials but also to electrodes and battery cells.

Figure 3: Supply chain position of the main Japanese patent assignees in the inorganic electrolyte-based solid-state lithium-ion battery patent landscape.

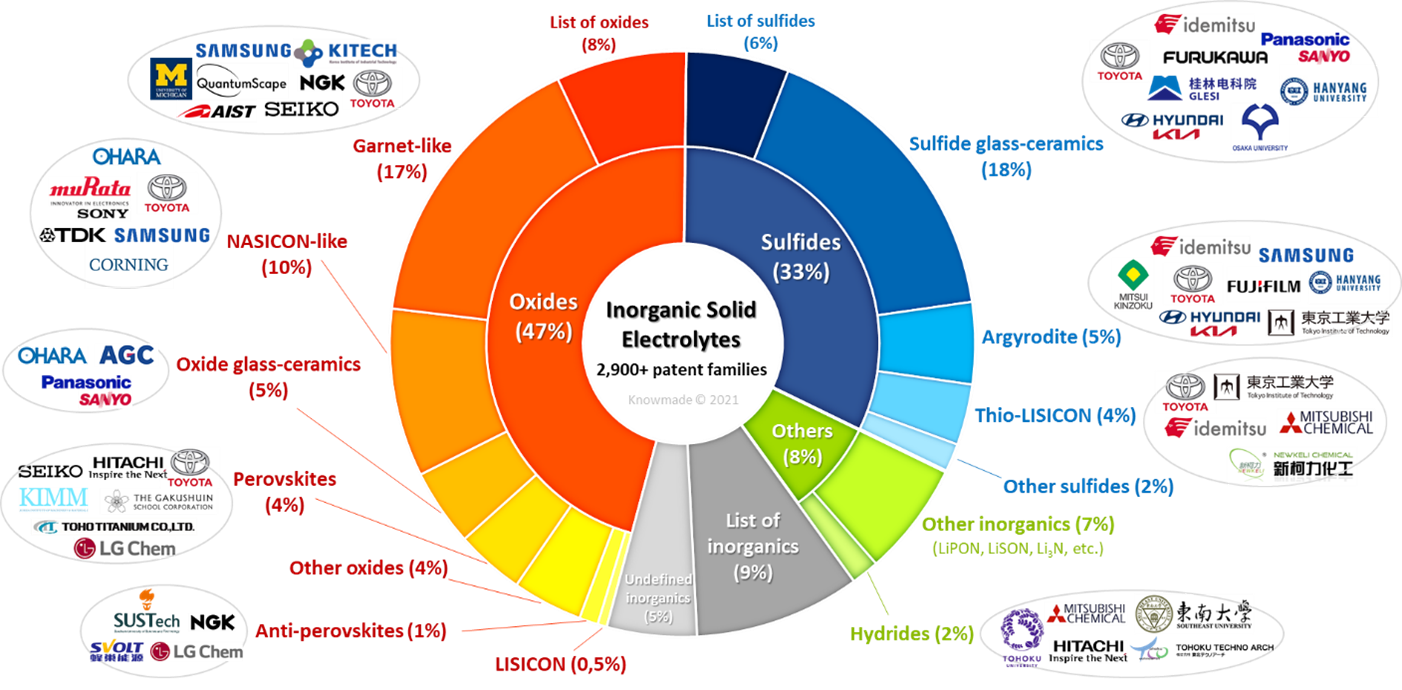

The electrolyte material is the key component in solid-state batteries. Close attention has been paid to the development of new inorganic solid electrolytes with improved ionic conductivity at room temperature, a wide voltage window vs. Li, high chemical compatibility with electrode materials, high resistance to mechanical stress and simple and low-cost manufacturing processes. These R&D developments have resulted in a large choice of inorganic materials which can be classified into several categories: oxides (oxide glass ceramics, anti-perovskites, perovskites, NASICON-like, garnet-like, LISICON), sulfides (sulfide glass ceramics, thio-LISICON, argyrodite), hydrides, halides, etc.

Figure 4: Distribution of inorganic electrolyte materials claimed in patents related to solid-state Li-ion batteries, and the respective main patent assignees.

Patent assignees differ from each other by the inorganic solid electrolytes they claim in their patents. The Japanese patent assignees focused on oxide solid electrolytes are Ohara, Murata, NGK, TDK, Seiko, Kyocera, Honda, Toshiba and Fujitsu. Idemitsu Kosan, Sumitomo Electric, Fujifilm, Furukawa, Hitachi Zosen, Osaka University, Mitsui Mining & Smelting and NIMS mainly hold patents relating to sulfide solid electrolytes. Toyota, Panasonic/Sanyo, AIST and JX hold numerous patents relating to both oxide and sulfide solid electrolytes. Patenting activity in emerging halide solid electrolytes is led by Panasonic/Sanyo. Hitachi and Mitsubishi Chemical hold patents relating to another emerging solid electrolyte material (hydride). As for non-Japanese companies, the foreign competition is especially strong on garnets, NASICON and anti-perovskites.

Up to now, Japanese companies have occupied a key position in solid-state Li-ion batteries from a patent point of view. They hold the highest number of patented inventions in Japan and key foreign countries as well, and continue to file numerous patent applications. They have secured their IP position across the whole value chain and for most inorganic solid electrolyte materials, including the emerging hydrides and halides. They have constructed strong IP collaboration networks – not only between private companies and research organizations, but also between companies themselves. However, numerous Chinese newcomers, American start-ups and Korean companies have entered the IP landscape, starting or increasing their patenting activity across the whole value chain, for the most promising solid electrolyte materials. “From an IP viewpoint, Japanese companies are well armed to confront competitors and win the industrial race on solid-state batteries. They have to keep up their R&D and continue to enlarge and strengthen their IP portfolio, but they should also leverage their strong IP position and assert their patents in key countries, in order to hamper the freedom-to-operate of their competitors and thereby consolidate their leadership position in the solid-state battery market,” concludes Fleur Thissandier.

Knowmade just released a new Solid-State Li-ion Batteries Patent Landscape report to offer a complementary understanding of the battery competitive landscape, its evolution through, and the strategic and technological paths the leading companies and newcomers are following for solid-state lithium ion batteries. All year long, Knowmade’s team investigate patenting activities related to batteries to get a deep understanding of the technology and intellectual property evolution, and their potential business impact. This Solid-state Li-ion batteries report is part of a collection of IP reports and IP monitors including Solid Electrolytes for Li-ion Solid-State Batteries Patent Landscape and Solid-State Batteries Patent Monitor.

Find in-depth insights of Battery technologies.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Fleur Thissandier, PhD, Fleur works for Knowmade in the field of Materials Chemistry and Energy storage. She holds a PhD in Materials Chemistry and Electrochemistry from CEA/INAC, (Grenoble, France). She also holds a Chemistry Engineering Degree from the Superior National School of Chemistry (ENSCM Montpellier, France). Fleur previously worked in battery industry as R&D Engineer.

About Knowmade

Knowmade is a Technology Intelligence and IP Strategy consulting company specialized in analysis of patents and scientific information. The company helps innovative companies and R&D organizations to understand their competitive landscape, follow technology trends, and find out opportunities and threats in terms of technology and patents.

Knowmade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patents and scientific information into business-oriented report for decision makers working in R&D, Innovation Strategy, Intellectual Property, and Marketing. Our experts provide prior art search, patent landscape analysis, scientific literature analysis, patent valuation, IP due diligence and freedom-to-operate analysis. In parallel the company proposes litigation/licensing support, technology scouting and IP/technology watch service.

Knowmade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Solid-State Sensors/Actuators, Semiconductor Manufacturing, Packaging & Assembly, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.