SOPHIA ANTIPOLIS, France – January 30, 2025 │ The last quarterly report for the 2024 Therapeutic mRNA patent monitor is now available! As we leave behind another year, we look back on the mRNA therapeutic patenting activity! The year 2024 marked another dynamic period for technological innovation in mRNA therapeutic area, the race for intellectual property (IP) dominance continued, reflecting the fierce competition.

Global Patent Filing Dynamics: A Slight Increase in 2024

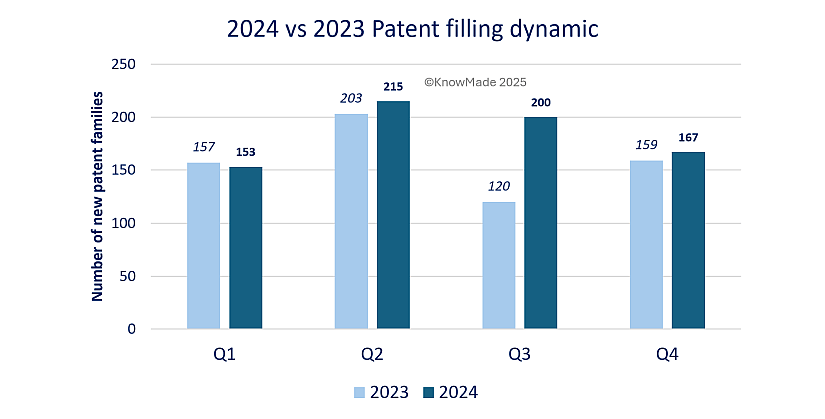

On a global scale, patent filing activity experienced a modest increase in 2024, with 735 new patent families published compared to 639 in 2023, as illustrated in figure 1. This upward trend reflects the growing emphasis on innovation across industries and geographies. The most significant difference was observed in Q3, where 200 patent families were published in 2024, compared to just 120 during the same period in 2023. This surge highlights a particularly productive quarter, for more detail see Q3 2024 Press release.

Figure 1: 2024 vs. 2023 new publications activity overview

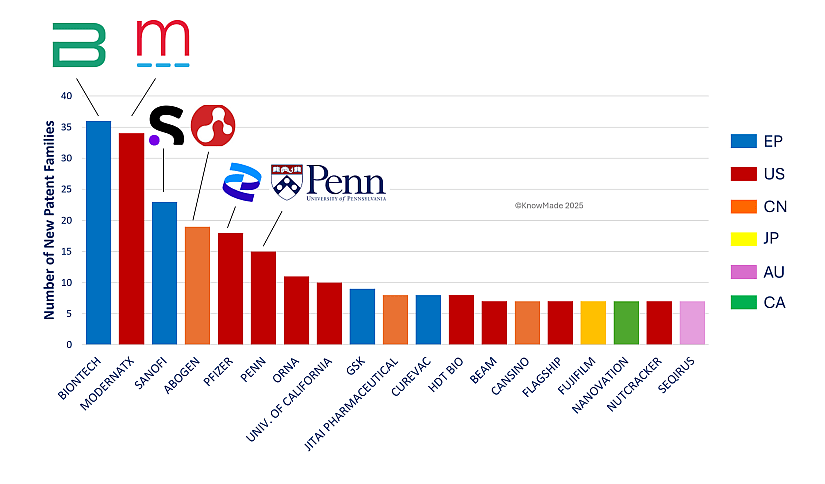

The geographic distribution of the top 20 entities filing patents in 2024, as shown in Figure 2, reveals notable trends that build on patterns observed in 2023. The United States retains its leading position, with half of the top players originating from the country. This dominance is supported by a robust ecosystem that blends established industrial giants, dynamic startups, and strong academic contributors in this technological field. Europe also demonstrates its commitment to advanced technologies, with four entities among the top 20, reflecting the region’s consistent focus on biotechnology and healthcare. Meanwhile, China continues its rise as a major force in mRNA therapeutic innovation, with three entities included in the top 20. Notably, across the broader patent corpus, Chinese academic institutions are particularly well-represented. These trends underscore the increasingly globalized landscape of technological innovation, where diverse regions contribute to advancements and foster competitive excellence on a global scale.

Figure 2: 2023 Patent filing activity for main industrial players

The 20 first players of the figure represent almost 50% of the whole patent filing activity of 2024. European players are in blue, US in red, Chinese in orange, Japanese in yellow, Australian in purple and Canadian in green. Are also highlighted the following players for 2024: BIONTECH, MODERNA, SANOFI, ABOGEN, PFIZER, and PENN UNIVERSITY.

Top 5 players in 2024

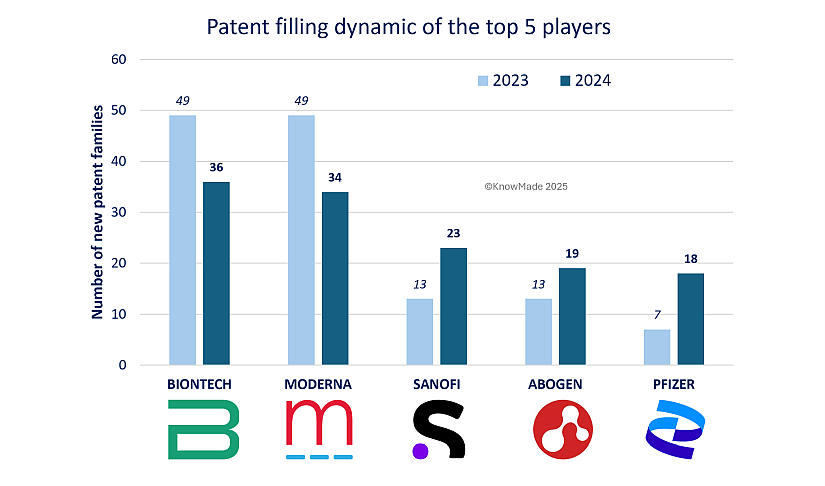

BioNTech and Moderna: Sustaining Leadership in Innovation

BioNTech and Moderna have reaffirmed their positions as leaders in mRNA therapeutic patenting activity in 2024. These industry giants are still dominating the landscape of mRNA therapeutics with 36 and 34 new patent families, respectively. Their ongoing competition is exemplified by the development of mRNA vaccines targeting monkeypox, as detailed in KnowMade’s September 2023 Insight. Both companies’ patent filings for monkeypox vaccines show that they both rely on mRNA platforms with lipid nanoparticles (LNPs) to produce monkeypox vaccines, but they have different approaches. BioNTech and Moderna are in a fierce competition to advance innovation in mRNA therapies, particularly for emerging infectious diseases, as evidenced by the close filing dates of these applications. However, both companies experienced a slight decline in their patenting activity compared to 2023, see figure 3. Despite this, their consistent IP activity underscores their commitment to maintaining a competitive edge in an evolving market. It also highlights their role in addressing global health challenges, where new technologies and treatments are pivotal.

Sanofi, Abogen, and Pfizer: Rising Stars in the Top Five

Sanofi, Abogen, and Pfizer have emerged as key players in 2024, making notable strides within the top five. Sanofi climbed to third place with 13 new patent families published, a significant rise from its fifth position in 2023. This growth aligns with its “challenger position” identified at the end of 2023 (see our Insight), demonstrating the company’s focus on expanding its technological portfolio, bolstered by its acquisition of Translate Bio. Beyond vaccines, Sanofi continues to develop solutions for therapeutic challenges in oncology, immune-related diseases, and rare conditions, solidifying its broader impact on innovation.

Abogen also advanced to fourth position in 2024 with 13 new patent families, highlighting its growing prominence in biotechnology. Known for its expertise in mRNA technology, Abogen has quickly established itself as a significant player since its founding in 2019, particularly in developing cationic lipids for lipid nanoparticle (LNP) systems. Due to its youthful yet extensive portfolio, strong emphasis on lipidic components, and innovation in therapeutic areas, the company is a dynamic force in the evolving field of mRNA delivery.

Pfizer, meanwhile, made a remarkable return to the forefront in 2024, rising from 14th place in 2023 to secure the fifth position. This resurgence is driven by patent families primarily focused on vaccines targeting respiratory diseases such as influenza, RSV, and pneumonia.

Figure 3: 2024 vs 2023 Patent filing activity for the top 5 players

The Critical Role of Delivery Systems in mRNA Therapeutics

Delivery systems remain a cornerstone of mRNA therapeutic development, representing a critical segment of innovation within the MedTech industry. As mRNA technologies evolve, the importance of efficient, targeted, and safe delivery mechanisms becomes increasingly evident, ensuring the stability, cellular uptake, and efficacy of therapeutic payloads.

LNP Systems: Continued Innovation and Strategic Interest

Lipid nanoparticle (LNP) technology continues to dominate as a delivery method for mRNA therapies. Companies like Abogen, a top-five patent filer in 2024, have emphasized innovations in this space, particularly through their development of cationic lipids tailored for LNP systems. Abogen’s rapid rise as a leader in mRNA delivery exemplifies the field’s dynamic progress.

The acquisition of ReNAgade by Orna Therapeutics in 2024 further highlights the strategic importance of LNP systems. Orna’s circular RNA technology, now combined with ReNAgade’s LNP-based RNA delivery systems, detailed in KnowMade insight from November 2023, underscores the industry’s commitment to advancing RNA-centric approaches. Orna’s leadership views this merger as transformative, enabling breakthroughs in RNA-based medicine, including panCAR therapies for oncology, gene editing solutions, and autoimmune treatments. According to Orna’s CEO, see Orna’s Press release, Mr. Munshi, this unification positions the company to “eclipse traditional cell therapy methods and reshape the future of medicine.” This strategic move not only validates the critical role of delivery systems but also underscores their potential to overcome persistent challenges in drug development.

Exploring Novel Delivery Mechanisms: AGS Therapeutics

Beyond LNPs, groundbreaking new delivery technologies are emerging. French biotech company AGS Therapeutics exemplifies this trend with its development of microalgae extracellular vesicles (MEVs) as a delivery platform, see our detailed Insight from November 2024. Founded in 2020, AGS leverages MEVs derived from the freshwater microalga Chlorella vulgaris, a source that offers several distinct advantages. MEVs are inherently non-toxic and non-immunogenic, ensuring their safety for therapeutic applications. Additionally, MEVs demonstrate innovative delivery capabilities, including the ability to cross natural body barriers, enabling oral administration, lymphoid tissue targeting, and nose-to-brain delivery. These features allow MEVs to overcome many of the limitations associated with traditional LNP systems, positioning AGS Therapeutics as a pioneer in the evolving field of mRNA delivery.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Elodie Bovier, PhD., works at KnowMade as a Patent Analyst in the field of Biotechnology and Life Sciences. She holds a PhD in genetic and molecular biology from the Paris Sud University. She also holds the Industrial Property International Studies Diploma (in Patent and Trademark & Design Law) from the CEIPI (Strasbourg, France).

About KnowMade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.