SOPHIA ANTIPOLIS, France – April 1, 2025 │ Integrated Sensing and Communication (ISAC) is rapidly emerging as a pivotal innovation within the wireless communication industry, shaping the evolution of 5G-Advanced and 6G technologies. Since 2020, around 2,000 related patent families have been filed globally, underscoring significant strategic investments by major telecom companies. By integrating radar-like sensing capabilities into cellular networks, ISAC enables networks not only to deliver traditional connectivity but also to accurately capture the location, velocity, and condition of objects within their environment.

Driven by technological advancements and rising demands in autonomous driving, drone logistics, smart cities, and Industry 4.0, ISAC technology is becoming foundational for future network infrastructure. This analysis examines the global patent landscape, strategic positioning by key industry and academic players, and technological development paths, assisting organizations in navigating and strategically positioning themselves in this emerging technology sector.

A Five-Year Surge: ISAC Innovation Skyrockets

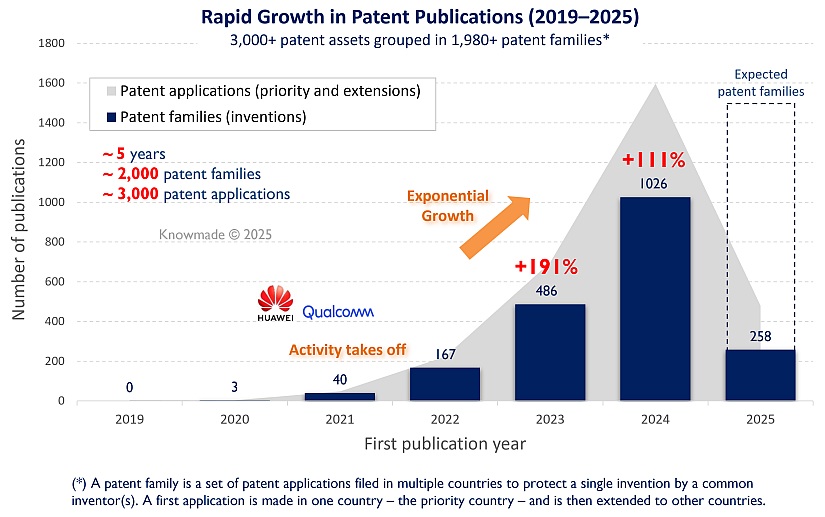

ISAC-related patent filings have witnessed exponential growth since Huawei and Qualcomm initiated their early patent applications in late 2020. As shown in Figure 1, this marked the beginning of an upward trajectory that has continued unabated, with annual patent filings more than doubling each year. The year 2024 alone saw over 1,000 new patent families published, indicating not just a technological shift but a full-scale race to secure intellectual property (IP) dominance in this emerging field.

Figure 1: Time evolution of patent publications related to integrated sensing and communication (ISAC) technology until Feb 2025.

Who’s Winning the Race: Industrial Giants and Academic Powerhouses

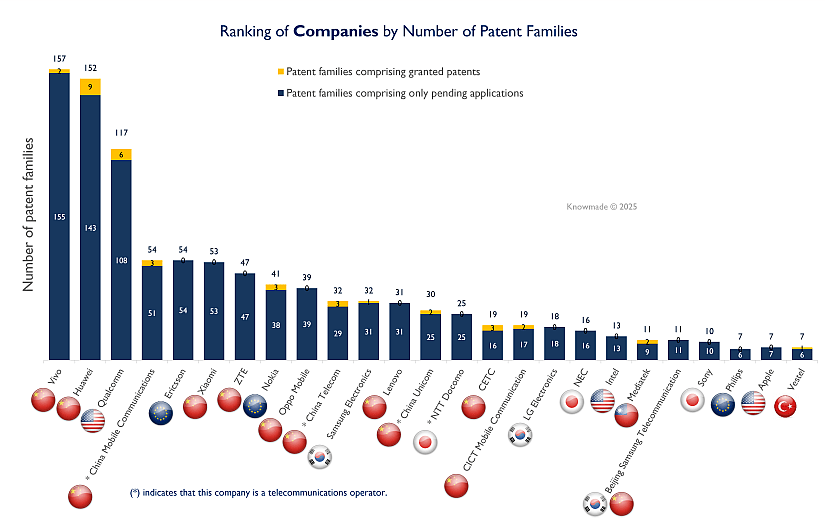

Within this trend, Chinese companies have emerged as key contenders. Figure 2 highlights the strong presence of firms such as Huawei, Vivo, and Qualcomm, each holding over 100 patent families. Traditional giants such as Ericsson, Nokia, and Samsung are keeping pace, while nearly every Chinese manufacturer—Xiaomi, ZTE, Oppo, among others—has actively joined the IP competition. Interestingly, major telecom operators, including China Mobile, China Telecom, and NTT, are also investing in ISAC-related IP, hinting at the role sensing may play across both network infrastructure and services.

Figure 2: Ranking of industrial patent assignees according to the number of their patent families (inventions) related to integrated sensing and communication (ISAC) technology.

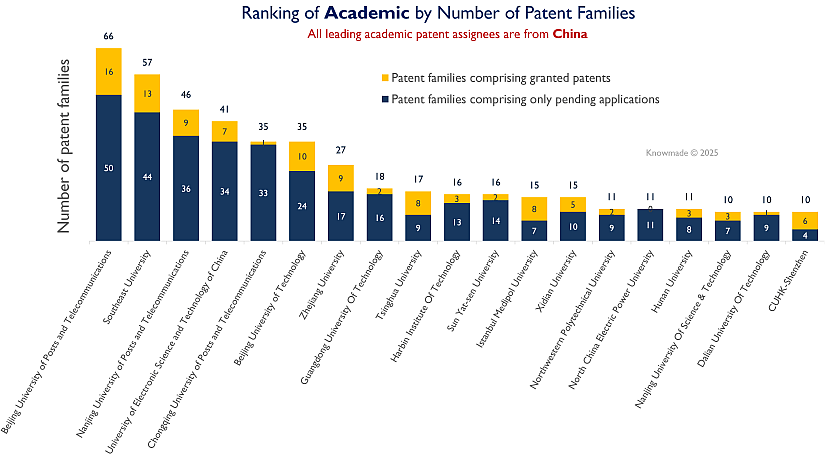

The academic contribution is notable but significantly more concentrated. As shown in Figure 3, almost all leading academic patent assignees are Chinese universities. This reflects China’s institutional focus on securing core sensing technologies—likely a product of aligned state policies, funding programs, and proactive university-industry IP strategies. Western academic institutions are notably absent—a reflection of their general preference for publishing research over filing patents. This may explain their limited presence in the ISAC IP landscape despite active research efforts.

Figure 3: Ranking of academic patent assignees according to the number of their patent families (inventions) related to integrated sensing and communication (ISAC) technology.

Global Filing Patterns and Patent Leadership

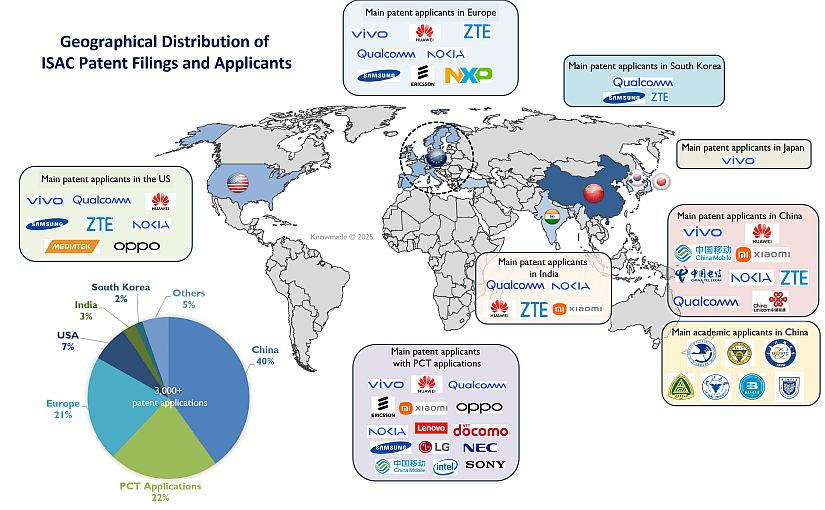

Geographically, Figure 4 shows that nearly 40% of patents have been filed in China, including a notable number of filings by non-Chinese companies such as Qualcomm and Nokia. Europe accounts for 21% of patent filings, primarily by Vivo, Huawei, ZTE, Qualcomm, and Nokia. About 9% targeted the U.S. market, with major applicants including Vivo, Qualcomm, Huawei, and Samsung Electronics, and there is also some patenting activity in Japan, South Korea, and India. Let’s note that 22% of patent filings used the PCT route—mainly by Vivo, Huawei, Qualcomm, Ericsson, Xiaomi, and others—seeking patent protection internationally for their inventions. This distribution reinforces that China is undoubtedly the earliest and most active market in embracing ISAC technology. That said, ISAC is far from being a regional phenomenon—global adoption is steadily gaining momentum, as evidenced by the broad international coverage sought by companies like Qualcomm, Huawei, Ericsson, and Nokia through EP and PCT filings.

Figure 4: Filing countries of patent applications on integrated sensing and communication (ISAC) technology, and main patent applicants.

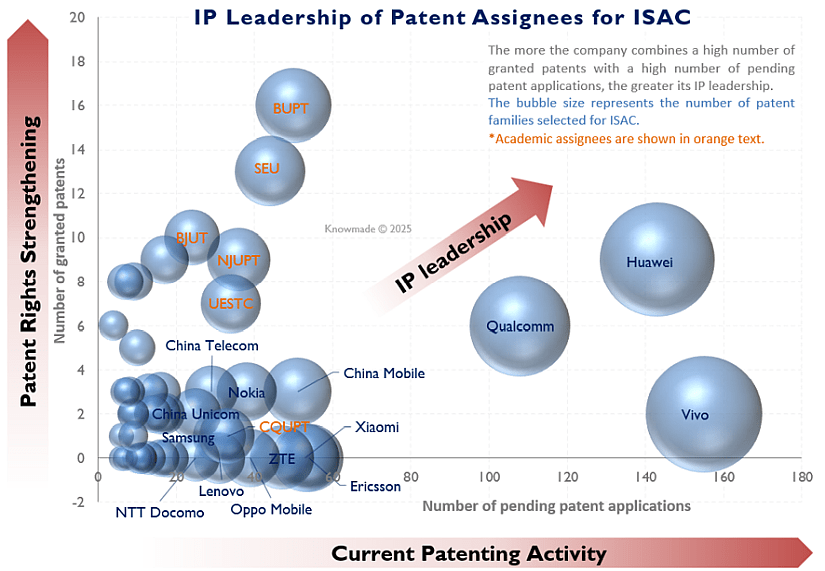

Figure 5 offers important nuance: as ISAC is still a nascent field, the vast majority of patent applications are pending. Chinese patent applications benefit from faster examination cycles by the China National Intellectual Property Administration (CNIPA), allowing them to lead in granted patents for now. Huawei, Qualcomm, and Nokia are already beginning to see their early applications granted. In contrast, Vivo, although currently holding the highest number of ISAC-related patent applications, still has most of them pending, highlighting its recent but aggressive entry into this space.

Figure 5: IP leadership of patent assignees for integrated sensing and communication (ISAC) technology.

Strategic Outlook: From Innovation Hotspots to Long-Term Advantage

Beyond patent counts, ISAC’s trajectory is being shaped by its alignment with global standardization efforts. ETSI ISG ISAC, among others, is helping define key innovation directions:

- Developing 6G-focused use cases not addressed in current standards

- Advancing channel models to support unified sensing-communication frameworks

- Redesigning system and RAN architectures for deeper integration

- Defining KPIs, security frameworks, and sustainability metrics

These efforts highlight that ISAC is more than a feature—it’s becoming a foundational component of future wireless ecosystems. The current wave of patent filings may soon evolve into contributions to Standard Essential Patents (SEPs), as ISAC-related technologies mature and become embedded into global network specifications. Early IP holders are well-positioned to influence standard-setting processes and unlock long-term licensing value.

With standards solidifying and sensing becoming integral to adaptive, AI-native networks, those with foresight in IP positioning today will define the value chains of tomorrow. ISAC is not just an upgrade—it is redrawing the technological and IP landscape of wireless communications. The battlefield is drawn. The next frontier is sensing.

To further explore ISAC technology and gain deeper insights into its trends and competitive landscape, feel free to contact us.

Press contact

contact@knowmade.fr

Le Drakkar, 2405 route des Dolines, 06560 Valbonne Sophia Antipolis, France

www.knowmade.com

About the author

Yanni ZHOU, PhD., works at KnowMade in the field of RF Technologies for Wireless Communications, Sensing, and Imaging. She holds a Ph.D. in RF and Wireless Communication from the University of Lyon, INSA Lyon, INRIA, France, and an Engineer’s Degree in Electrical Engineering from INSA Lyon, France. Yanni previously worked at Nokia Bell Labs, Strategy & Technology, focusing on 5G/6G and RF front-end systems. She developed innovative RF solutions effectively integrated into communication and radar systems. Her work also includes designing advanced radar sensing and imaging systems for accurate detection in complex environments.

About Knowmade

KnowMade is a technology intelligence and IP strategy consulting company specialized in analyzing patents and scientific publications. The company helps innovative companies, investors, and R&D organizations to understand the competitive landscape, follow technological evolutions, reduce uncertainties, and identify opportunities and risks in terms of technology and intellectual property.

KnowMade’s analysts combine their strong technology expertise and in-depth knowledge of patents with powerful analytics tools and methodologies to turn patent information and scientific literature into actionable insights, providing high added value reports for decision makers working in R&D, innovation strategy, intellectual property, and marketing. Our experts provide prior art search, patent landscape analysis, freedom-to-operate analysis, IP due diligence, and monitoring services.

KnowMade has a solid expertise in Compound Semiconductors, Power Electronics, Batteries, RF Technologies & Wireless Communications, Solid-State Lighting & Display, Photonics, Memories, MEMS & Sensors, Semiconductor Packaging, Medical Devices, Medical Imaging, Microfluidics, Biotechnology, Pharmaceutics, and Agri-Food.